The Government of Punjab, Finance Department, issued a notification dated December 2, 2024, stating that various pension increases given from prior years would be discontinued. That means the future retiring employees will not get the pension increases they were granted in 2011, 2015, and 2022. The details are described below:

Discontinuing Increases in Pension 2024 During Different Years in Punjab

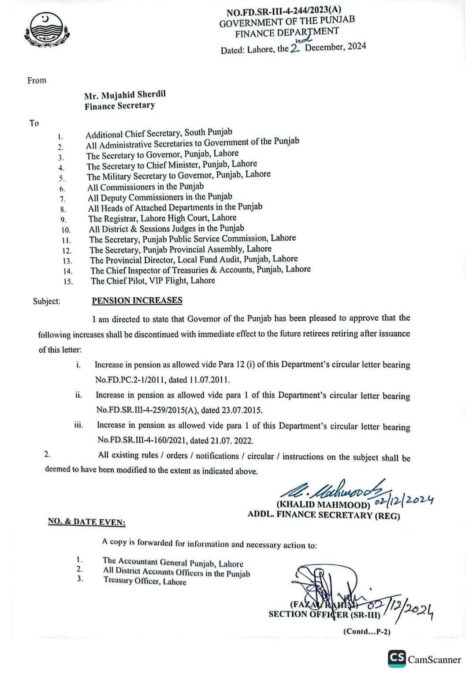

I am directed to state that the Governor of Punjab has been pleased to approve that the following increase shall be discontinued with immediate effect to the future retired retirees retiring after the issuance of this letter:

- Increase in pension as allowed vide Para 12 (I) of this Department’s circular latter being No.FD.PC.2-1/20211, dated 11-07-2011.

- Increase in pension as allowed vide para 1 of this Department’s circular letter beading No. FD.SR-III-4-259/2015(A), dated 23-07-2015/

- Increase in pension as allowed vide para 1 of this Department’s circular letter bearing No.FD.SR.III-4/160/2021, dated 21-07-2022.

All existing rules/orders/notifications/circulars/instructions on the subject shall be deemed to have been modified to the extent indicated above.

What does Pension Decrease Mean? (Explanation)

The Punjab Government civil servants are entitled to the following pension increases on retirement:

15% Pension Increase from 01-07-2011

7.5% Pension Increase from 01-07-2015

15% Pension Increase from 01-07-2022

However, the Finance Department has issued a new notification stating that the above increases will not be included in the pensions of the future pensioners of the Punjab Government. On the other hand, Federal Government employees will get these increases, along with the additional pension increases given in 2023 and 2024.

On the other hand, the Punjab government has also issued the Notification of Amendment Pension Rules 2024 for the reduction factor on early age retirement. It also mentioned the average basic pay of three years for pension calculation as well as a family pension to the spouse for 10 years.

You will have to take the average pay for the last three years starting from July of each year. The remaining factors are the same for the formula only. If you take retirement before the age of 60 years then you will have to make a deduction of 2% for each year.

View the notification of Decrese in Pension

Also read:

- M.Phil, MS, PhD and LLM Allowance to Employees Across the Board

- Upgradation of Computer Operator BS-15 to BS-16

To kia next time hamen peechla ye increase nai mily ga?

No brother as per notification, ap nai lay sakty previous increase.