CSS & PMS

CSS Examination

PMS Examination

Judiciary, Law & LL.B

Judiciary

Law & LL.B Examination

LAT, GAT & USAT

LAT Examination

GAT & USAT Examination

Other Educational Stuff

Resources

Govt. Notifications

Our Income Tax Return Master Course is Available Now

Most Recent Updates

- How to Register as DNFBP in FBR IRIS (Complete Guide) NEW

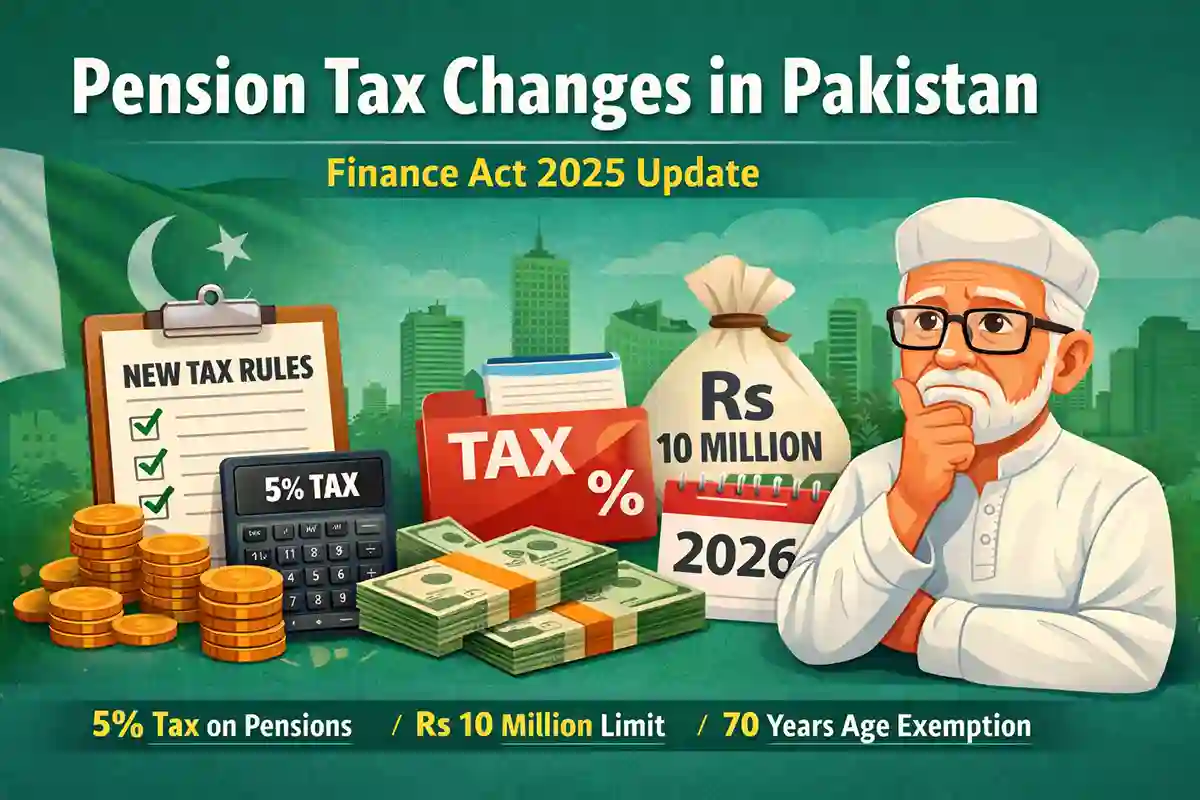

- Pension Tax in Pakistan After Finance Act 2025 Explained

- How to File US Employment Tax Return – Forms 941, 940 and W-2 Explained

- How to File U.S. Estate & Trust Tax Return – Form 1041 Explained

- How to File US Nonprofit Organizations Tax Return – Form 990 Explained

- How to File US Business Tax Return – Forms 1065, 1120, 1120-S

Articles

LAT Past Papers

-

LAT Past Paper 24 November 2024 (solved)

-

LAT Past Paper 11 August 2024 (solved)

-

Law Admission Test (LAT) Past Paper 04 February 2024

-

Law Admission Test (LAT) Past Paper 12 November 2023

-

Law Admission Test (LAT) Past Papers 27 August 2023

-

Law Admission Test (LAT) Past Papers 16 July 2023

-

Law Admission Test (LAT) Past Papers 22 January 2023