In Pakistan, professional Charges are typically not directly deducted from your personal income tax return. But in other cases, they may have an indirect effect on your taxable income. In this article, you will learn about professional charges in tax returns in Pakistan.

Recognizing the Distinction Between Tax Deductions and Professional Fees

Professional Charges

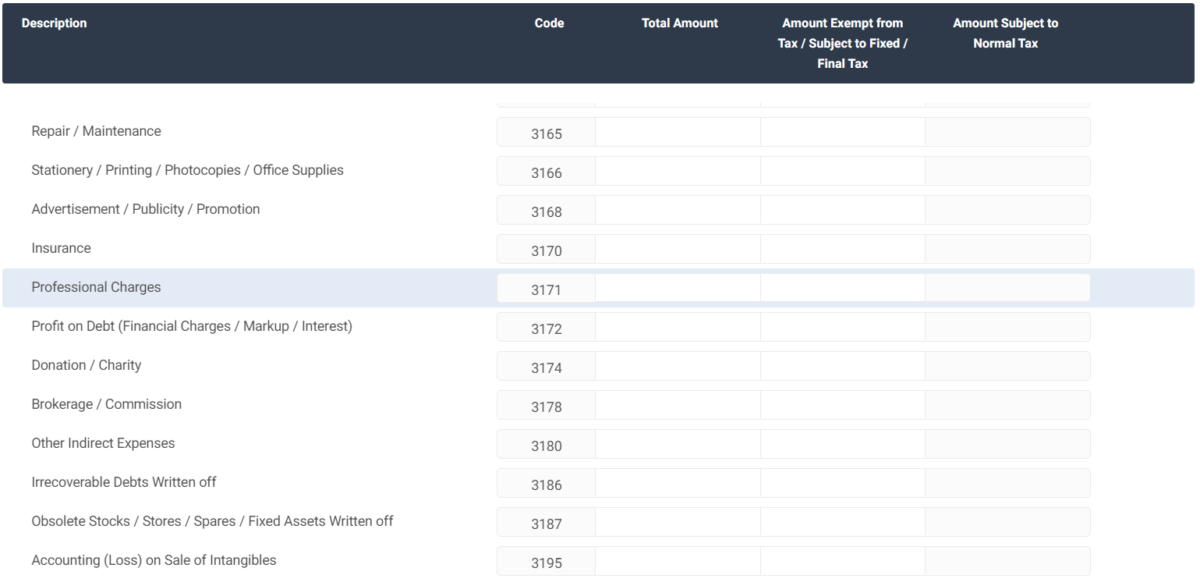

These are charges paid to professionals like accountants, lawyers, or consultants for services rendered. In Pakistan business person hired different professionals to manage their business. When you file your tax returns you can declare the sum of these charges in your business income tax returns against the head of “Professional Charges” in the normal tax return form as seen in the below image.

Tax Deductions

These are specific expenses allowed by the tax law to be subtracted from your income, reducing your taxable amount. When you declare your adjustable taxes they reduced your total tax lability. For example, you have tax liability of Rs. 5000 and when you declare your tax deductions of Rs. 3000, it will minimize your tax total tax liability. That’s why you pay less tax than you original.

How Professional Charges Can Impact Your Tax Return

While not a direct deduction, professional charges can influence your taxable income in the following ways:

Business Income

If you own a firm, professional fees are considered business costs and can be deducted from your profits. This reduces your total taxable profit.

Capital Gains

If you’re selling an asset and paying professional fees for valuation or legal advice, you can deduct these expenses from the sale proceeds when calculating capital gains.

Rental Income

For property owners, professional fees related to property management or legal advice can be deducted from rental income.

Important Considerations for Professional Charges

Maintain adequate records of professional charges, including invoices and receipts. To understand if an expense is deductible, you must first define its purpose. Keep up with the newest tax rules and regulations, as they may change.

Professional Tax

It is important to note that in Pakistan there is another tax called “Professional Tax” which is levied by provincial governments on persons engaged in any profession, trade, occupation or employment.

This is a different tax from the income tax deduction explained above.

If you have specific questions about your tax situation, you should consult a qualified tax advisor in Pakistan who will be able to provide you with advice tailored to your individual situation. It is important to note that in Pakistan there is another tax called “Professional Tax” which is levied by provincial governments on persons engaged in any profession, trade, occupation or employment.

I am sure now you have completely understand the professional charges in Pakistan and its treatment in income tax return.

Also read:

- Is Income Tax Deduction on Electricity Bills in Pakistan Refundable? (Section 235 Explained)

- How to File Tax Return for Salary Person in 2024

- How to Make NTN in 2023 for Salary and Business

- Tax Return Master Course

I am dual National, want to pay tax as required, please update your email, or WhatsApp Ph #.

You are non resident Pakistnai you don’t need to pay tax.

That is really good to know.