If you are a salary person and earns taxable income in Pakistan then filing tax return is a legal obligation for you. To make is simple, if you earn 600,000 per year from your salary whether you are a government servant or getting salary from any private organization you are still liable to submit tax return with in due date. In this article, you’ll know How to File Tax Return for Salary Person in 2024. Filing Income Tax returns 2024 is compulsory for all the National Tax Number (NTN) holders if they earn a taxable income per year.

For this purpose, first you have to register with the FBR. By registering with FBR you are making your NTN. NTN is the first procedure in Filing the Income Tax Return in Pakistan 2024. To make NTN in Pakistan you can watch this video or you can read this article.

You can simply Contact Us or follow my step-by-step procedure to learn to file income tax returns in 2024.

You can also enroll in our Income Tax Return Master Course 2024 by pressing the apply now button.

Login to the IRIS portal

Open the IRIS Portal and log in with your CNIC and Password. You can use the same password that you created at the time of creating NTN.

If you have forgotten your password to IRIS Portal then you can click on the “forgot password” button. An email and a code will be sent to your mobile number and email address. Simply copy both of these and enter them into the relevant field in IRIS Portal.

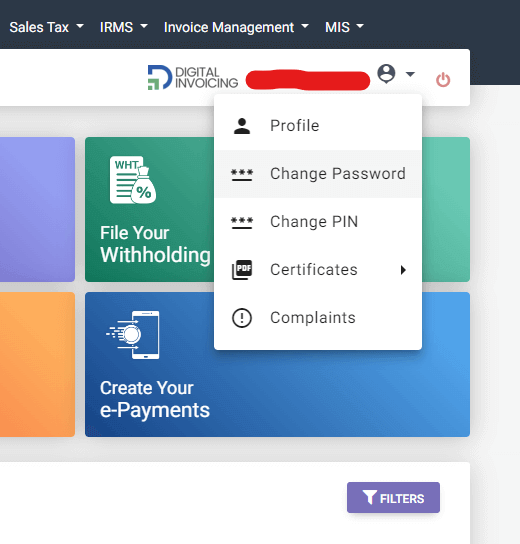

How to Change Password in IRIS Portal?

It happens many times that when a person logs in to the IRIS portal he no longer remembers the password he had generated at the time of registration. You can simply go to your profile icon, click on the “Change Password” option to create password or you can watch this video tutorial here.

File Your Income Tax Return

Filing an income tax return is quite tricky work. If you do not know how to file the income tax return as a salaried person, business person, or private company then you can Contact Us. Otherwise, follow the steps below. You can also watch this guide video for filing tax returns.

- there is a form namely “114” which is also called the income form.

- after that, you have to file the “form 116” which is also called a wealth statement.

- put all your income and wealth in the relevant sections of both of these forms.

- in the end, you have to reconcile both of these forms so that your calculations will be done perfectly.

How to Reconcile the Wealth Statement

To successfully submit and reconcile the wealth statement you have to do a perfect calculation in both of these forms. As you know every year’s income and expense change from another year that’s why if you did not reconcile the wealth statement then you are not allowed to submit/file your tax return. The system will halt you from filing the Tax Return.

That’s why the reconciliation of the wealth statement is very important. To file your Income Tax Return online, you must complete the Return of Income form and Wealth Statement (statement of assets & liabilities) form. Watch our video tutorial to learn about Wealth statements.

If you wish to learn in detail about Income tax return method then must enroll in this Income Tax Return Master course, Salary Course, Business Course, Freelancer Course, or Non-Resident Pakistani.

File Income Tax Return as a Salary Person

The Federal Board of Revenue (FBR) has issued a new form for the salary persons. To about this new form watch this video here.

It is made to facilitate the salaried person whose income is 50% more than any other income in a complete year. This declaration form is called 114(1). Both the Income and wealth statement is given in this newly created form.

Revised Tax Rates for Salary Person 2024-25

Here is a table with revised tax rates for salary persons. I have also give a comparison of 2023 tax year below so that you it will be more helpful for you to understand the current year’s tax rates with previous one.

| Sr. No | Taxable Income | Rate of Tax 2023-24 | Rate of Tax 2024-25 |

|---|---|---|---|

| 1 | Where taxable income does not exceed Rs. 600,000 | 0% | 0% |

| 2 | Where taxable income exceed Rs. 600,000 but does not exceed Rs. 1,200,000 | 2.5% of the amount exceeding Rs. 600,000 | 5% of the amount exceeding Rs. 1,200,000 |

| 3 | Where taxable income exceed Rs. 1,200,000 but does not exceed Rs. 2,200,000 | Rs. 15,000 + 12.5% of the amount exceeding Rs. 1,200,000 | Rs. 30,000 + 15% of the amount exceeding Rs. 1,200,000 |

| 4 | Where taxable income exceed Rs. 2,200,000 but does not exceed Rs. 3,200,000 | Rs. 165,000 + 22.5% of the amount exceeding Rs. 2,400,000 | Rs. 180,000 + 25% of the amount exceeding Rs. 2,200,000 |

| 5 | Where taxable income exceed Rs. 3,200,000 but does not exceed Rs. 4,100,000 | Rs. 435,000 + 27.5% of the amount exceeding Rs. 3,200,000 | Rs. 430,000 + 30% of the amount exceeding Rs. 3,200,000 |

| 6 | Where taxable income exceed Rs. 4,100,000 | Rs. 1,005,000 + 32.5% of amount exceeding Rs. 6,000,000 | Rs. 700,000 plus 35% of the amount exceeding Rs. 4,100,000 |

Revising the Income Tax Return

If you have filed your income tax return wrongly, then you don’t need to panic. We have made a proper video to guide you about revising your tax return. You can revise your income tax return within 5 years. Although this is not so easy to do. First, you have to submit an application in FBR and wait for their reply. If they approve your application then you can revise your income tax return.

You can learn how to Edit your Income Tax Return.

Revising the Wealth Statement

You can also revise/edit your wealth statement (assets & liabilities). We have made a proper video to guide you about revising your wealth statement. Please note that you can revise your wealth statement before receiving the notice under subsection 9 of section 122 Income Tax Ordinance 2001. In this case, you don’t need to submit an application to FBR. You can do it yourself.

Filing Income Tax After Due Date

In Finance bill 2024 there is a new section introduced that talk about those people who file their income tax returns after due that.

You can see this article here to get the idea.

So now if you file your tax returns after due that double tax will charged on your as compare to those tax filer how filed their tax return with in due date.

It is often asked by the people how to file income tax after the due date. For this reason, you have to file it as you are filing it within the due date. Simply follow the above-said procedure to file your income tax return after the due date.

Things to Remember

The common things that you must remember are:

- File your income tax return in-time

- Do perfect calculations

- Match your income with your previous year’s income

- Keep the record of your filed income tax return for at least 6 years.

Credits, Rebates, and Exemptions for Income Tax Return

You can only avail of these benefits when you are an active income taxpayer. These are not available for a non-taxpayer person.

Penalty for not Filing Income Tax Return

FBR has stated serious and clear instructions regarding not filing the income tax return. If you are earning a taxable income per year and still you don’t file your tax return then you will be prosecuted and penalized under Income Tax Ordinance 2001.

Penalty for not Filing Income Tax Return

FBR has stated serious and clear instructions regarding not filing the income tax return. If you are earning a taxable income per year and still you don’t file your tax return then you will be prosecuted and penalized under Income Tax Ordinance 2001.

| Contact Us for Filing your Income Tax Return |

Please fill out the below form to contact us for Filing your Income-tax Return. When you send the message, a member of our team will contact you for further details.