The National Tax Number (NTN) is a unique ID issued by the Federal Board of Revenue (FBR) – the tax regulatory authority in Pakistan. Individuals and organizations liable to pay income tax must have a National Tax Number (NTN). In this article, you will learn how To create NTN in 2025 for Salary and Business Persons. Creating NTN in 2025 is so important for every salary and business person.

Registering an NTN Number in Pakistan is not difficult if you understand basic concepts. These days Pakistani Tax culture is evolving very rapidly. We often heard about NTN, Filer, and Non-Filer terms. Many people still don’t know how to get an NTN Number in Pakistan. So, in this article, you will learn about making NTN Numbers and all the required documents.

The Federal Board of Revenue (FBR) made it compulsory for all salary or business individuals to register NTN numbers and after that file their income tax return upon reaching the taxable income, which is 6 lac in tax year 2025.

There is no problem if you get the NTN number and become a filer as there are so many benefits of becoming a filer but so many difficulties for non-filer people.

You can also enroll in our Income Tax Return Master Course 2025 by pressing the Apply Now button.

How do I Register with FBR?

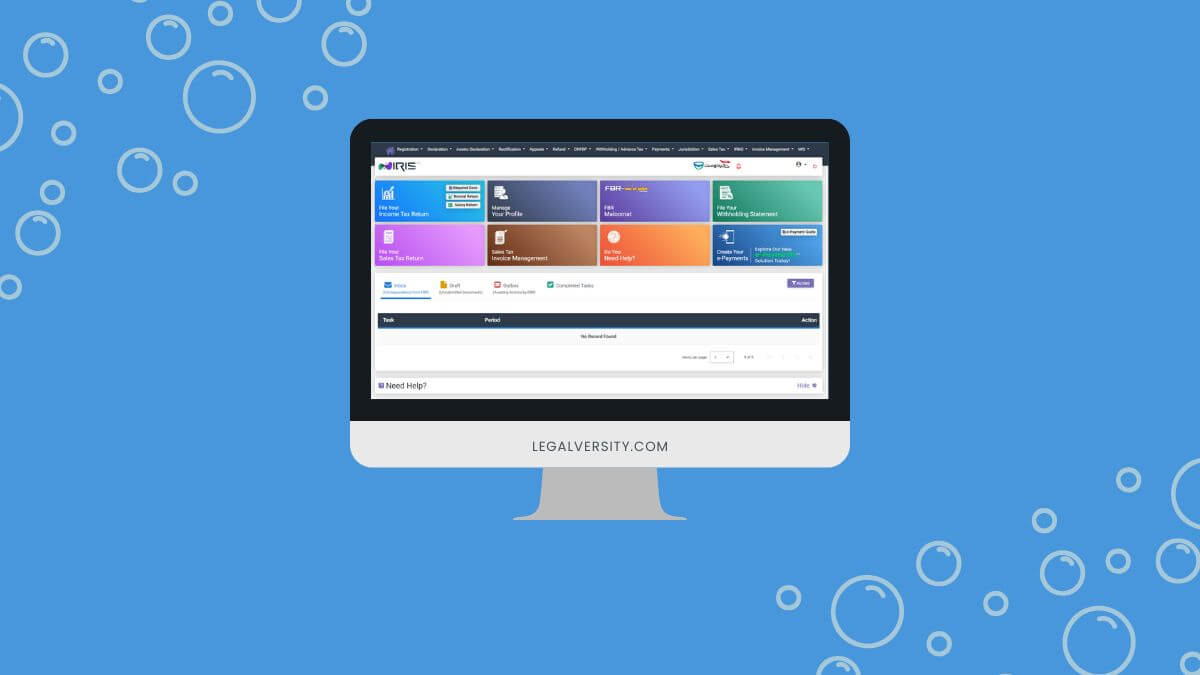

You need to create an account on the IRIS website for registration of your business or as a salaried person. In 2025 registering an NTN is very simple, you need to provide a few details about yourself and you are good to go.

These are the things that you need to register your NTN which are; CNIC, a cell phone that is registered on your name, your home address, and a personal Email address. I will discuss them in detail below.

What is NTN?

Every salary and business person receives an NTN which is a tax-paying identification number of about 8 digits. The National Tax Number can be used for importing and exporting goods, income tax, sales tax, and federal excise.

There are some other important documents that you need to collect before making an NTN or filing an income tax return.

What is the Benefit of NTN?

There are a lot of benefits for every NTN holder in Pakistan. These are mostly related to less payable taxes. For more detailed benefits you can refer to our guide about the Benefits of Becoming a Tax Filer.

Who is Eligible for NTN in Pakistan

The following persons are eligible for making NTN in Pakistan:

- Every individual business

- Every company

- Every AOP

- Every Association/NGO/NPO

- A salaried person has an annual income valuing PKR 600,000/- or above.

- Every professional registered with an association, council, or other registering authority e.g. engineer, doctor, lawyer, etc.

- Owner of 1000cc car or above

- Owner of 5 Marla Flat or House as the case may be.

- Others (who need to be a filer even if they don’t earn taxable income)

Required Documents for NTN?

There are different documents required for various categories of NTN but the following documents are absolute requirements for every category of NTN.

- Copy of CNIC.

- Phone Number.

- Email address.

- Home Address

How to Make an NTN Number for a Salary Person?

For making/registering an NTN Number you can simply Contact Us here.

In 2025 you need to have the following documents in hand before proceeding for the NTN.

- Original CNIC

- Mobile number registered in your name.

- A valid personal email address.

- Original certificate of maintenance of personal bank account in your name.

- Original proof of ownership or tenancy of business place (if you have a business).

- Original paid utility bill of business place (if you have a business then the bill should not be older than 3 months).

How to Make NTN Number for Associate of Person (AOP)

In 2025 an AOP (Associate of Person) can apply for NTN registration. You can also personally visit the tax office along with the following documents.

- Original Partnership deed (In case of Firm).

- Original Registration Certificate from Registrar of Firm (In case of a firm).

- CNIC of all Partners or Members.

- Mobile phone with the SIM registered in your name, but the SIM should not already be registered with FBR.

- The email address of AOP.

- Original certificate of maintenance of personal bank account in your name.

- Original proof of ownership or tenancy of business place (if you have a business).

- Original paid utility bill of business place (if you have a business the bill should not be older than 3 months).

NTN For Registration of a Company

The Principal Officer should personally go to the tax office for the registration of a company and take the following documents with you.

- CNIC of all Directors.

- Incorporation Certificate of the Company.

- Original letter on the letterhead of the company signed by all directors, verifying him as the Principal Officer and authorizing him for Sales Tax or Income Tax registration.

- Mobile phone with the SIM registered in your name, but the SIM should not already be registered with FBR.

- The email address of the company.

- Original certificate of maintenance of personal bank account in your Company’s name.

- Original proof of ownership or tenancy of business place (if you have a business).

- Original paid utility bill of business place (if you have a business the bill should not be older than 3 months).

How to Link your Department to IRIS

If you are a salary person you don’t need to file 181 from separately. When you register your NTN your 181 form is automatically filed. In 2025, to link your department with your tax return you need to visit your profile and then click on the employer tab. You will be prompted to enter the name of your department. In the link tab, you have to search your employer’s department by searching and then select your department from the results. this is how you can link your department to IRIS.

How to Add a Bank Account in IRIS

You can add your bank account to your IRIS account in your profile. To create NTN in 2025 you have to add your one bank account. If you have more than one bank account for your business or as a salaried person then you have to enter all of them and then click on the primary check button in front of the bank account.

How to Attach Evidence of Ownership and Utility Bills

If you want to edit your business details then you will need an 181 modification Form. When you save your edits in 181 From then save its copy as PDF on your computer. there is an option for Attachment. In this attachment tab, you have to add this PDF of the 181 Form as well as your evidence of ownership/tenancy along with paid utility bills. One thing to remember is that the utility bills should not be older than 3 months.

In conclusion, by following the above-mentioned step you will be able to register your NTN in FBR Pakistan. After registering your NTN the next step is to file your income tax returns. Without filing income tax returns, you can not become a filer.

Income Tax Return Master Course

If you wish to learn in detail about Income tax return method then must enroll in this Income Tax Return Master course.

Also read:

- File Income Tax Return in 2025

- Difference Between Private Complaint and Police Case FIR

- How to Change Personal Details, Name, and Address in NTN?

- FBR Tax Asaan App Review: Features and Benefits