The paper on Muslim Law & Jurisprudence is optional in the CSS competitive examination 2025. Here, you will find the CSS Muslim Law & Jurisprudence past Paper 2025. To give you a proper understanding of the paper I will also provide you a critical evaluation of this paper.

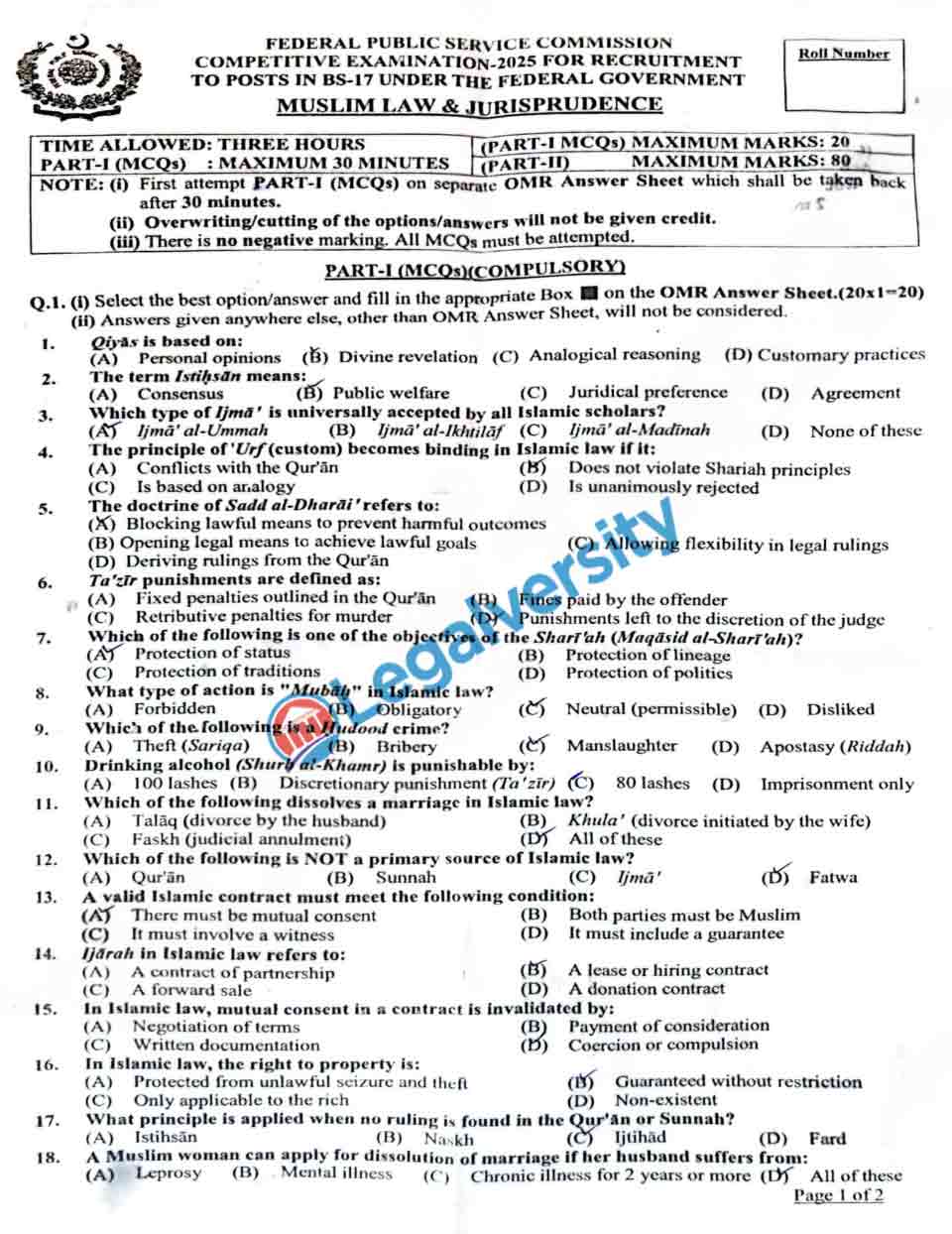

CSS Muslim Law & Jurisprudence Past Paper 2025

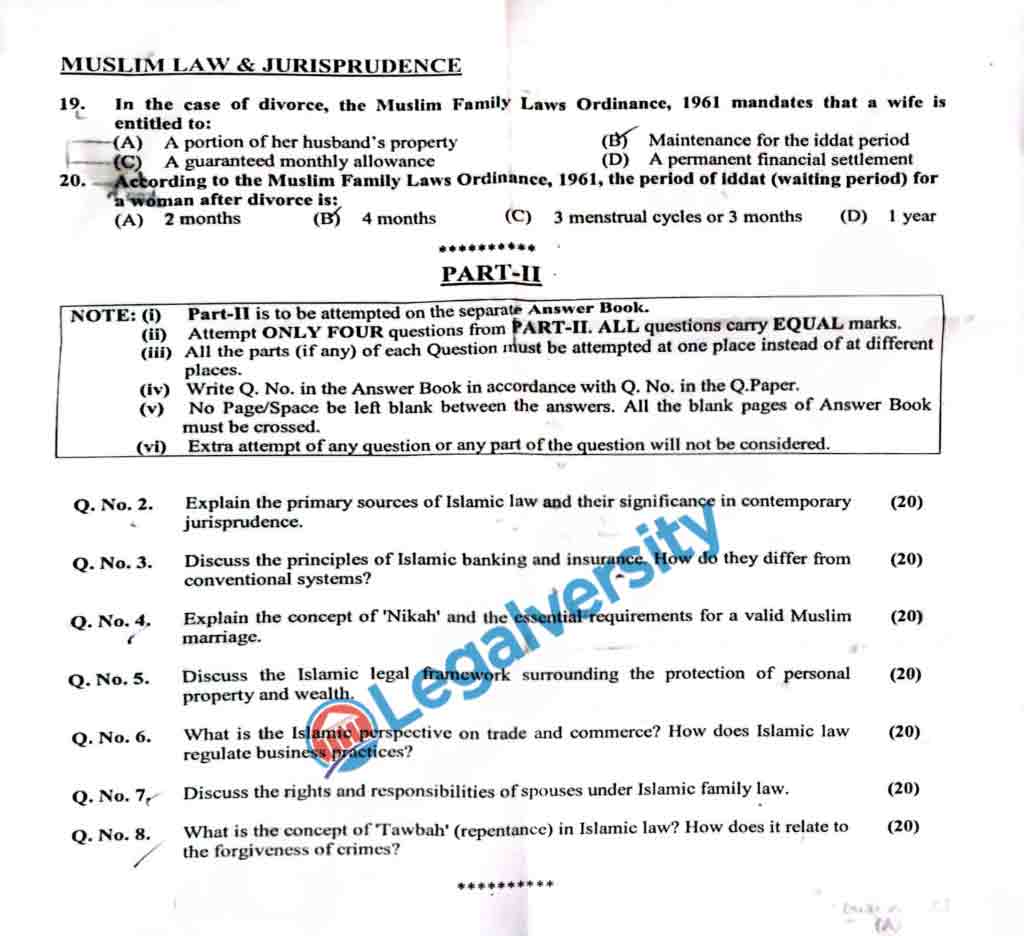

Q1. Explain the primary sources of Islamic law and their significance in contemporary jurisprudence.

Q2. Discuss the principles of Islamic banking and insurance. How do they differ from conventional systems?

Q3. Explain the concept of Nikah and the essential requirements for a valid Muslim marriage.

Q4. Discuss the Islamic legal framework surrounding the protection of personal property and wealth.

Q5. What is the Islamic perspective on trade and commerce? How does Islamic law regulate business practices?

Q6. Discuss the rights and responsibilities of spouses under Islamic family law.

Q7. What is the concept of Tawbah (repentance) in Islamic law? How does it relate to the forgiveness of crimes?

You can also learn about the MCQs of Muslim Personal Law

Critical Analysis of the Paper

Islamic law, or Sharia, is based on four main sources: the Quran, Sunnah (Hadith), Ijma (consensus), and Qiyas (analogical reasoning). The Quran, being the most basic source, gives direct commandments regarding legal issues, influencing ethical and social norms. The Sunnah, or the words and actions of Prophet Muhammad (PBUH), supplements the Quran by providing practical applications of its teachings. Ijma, or the consensus of Islamic scholars, is important in legal adaptation, keeping Islamic law applicable in modern times. Qiyas, or analogical reasoning, enables scholars to infer rulings for new circumstances by drawing analogies with existing precedents.

In contemporary jurisprudence, these sources continue to direct Islamic banking, family law, criminal justice, and commercial transactions, indicative of the shifting and versatile nature of Sharia in coping with new legal challenges. Islamic banking and insurance are conducted on principles that differentiate them from traditional financial institutions.

The ban on Riba (interest) is an essential pillar, ensuring that money-making is subject to ethical investments and collective risk. In contrast to conventional banking, where interest is levied on loans with or without profit or loss, Islamic finance requires profit-and-loss sharing arrangements like Mudarabah (venture capital financing) and Musharakah (joint ventures). Gharar (excessive uncertainty) and unethical speculation are prohibited as well to ensure the transparency of financial transactions and social accountability.

In the case of Takaful (Islamic insurance), risk is shared among policyholders collectively instead of transferring it to an insurance company for gain. These principles guarantee fairness, economic stability, and social justice, upholding the ethical underpinnings of Islamic finance in an increasingly dynamic global economy. The institution of Nikah (marriage) in Islam is a holy and contractual union subject to explicit legal conditions. A valid Nikah necessitates mutual agreement of both parties, a Mahr (dower) presented to the bride, two witnesses, and a public declaration.

In contrast to Western marriage systems, which prioritize civil registration, Islamic marriage is a religious contract of legal and spiritual importance. Contemporary interpretations of Nikah, however, point to women’s right to consent and the changing role of court-registered marriages to secure legal rights in the event of disputes. While polygamy is permitted in traditional Islamic law on very strict conditions, modern-day controversy revolves around women’s rights, family obligations, and gender equality within the Islamic family law paradigm.

The protection of personal wealth and property in Islamic law is rooted in principles of ownership, virtuous acquisition, and social responsibility. Islam does acknowledge private property but has strict prohibitions against theft, deception, and exploitation. Economic justice is ensured by Zakat (compulsory charity), which redistributes wealth to the poor.

Laws of inheritance (Mirath) ensure equitable distribution among inheritors, avoiding economic inequality among families. In contrast to capitalist economies that favor unlimited accumulation of wealth, Islamic law has a balanced approach, favoring entrepreneurship with social responsibility.

This system still impacts contemporary Islamic finance, corporate ethics, and consumer protection legislation. Trade and business in Islam have deep roots in moral business practices, contract enforcement, and justice. The Prophet Muhammad (PBUH) was himself a trader, and Islamic law fosters lawful earnings under the head of Halal but strictly forbids deception, monopoly, and fraud.

Islamic law of commerce directs complete transparency in transactions, barring exploitative contracts, and ethical workmanship. In contrast to traditional business practices that tend to favor profit at the expense of ethics, Islamic trade laws prioritize mutual benefit and social welfare.

Today, these values are enshrined in Islamic banking contracts, corporate social responsibility guidelines, and global trade agreements that ensure fair trade and economic justice. The rights and obligations of spouses under Islamic family law are mutual, guaranteeing harmony, protection, and economic security.

A husband is bound to offer Nafaqah (maintenance), justice, and protection, whereas a wife is entitled to maintenance, inheritance, and respect within marriage. In contrast to patriarchal misconceptions, Islamic law provides women the right to file for divorce (Khula), inherit property, and be involved in financial matters. Nevertheless, modern-day controversies question traditional roles, demanding legal reforms ensuring gender equality within the boundaries of Sharia. The current debates regarding women’s rights, polygamy, and marriage laws reflect the dynamic nature of Islamic family jurisprudence in contemporary societies.

Tawbah (repentance) in Islamic law is a rich concept that emphasizes divine mercy, individual responsibility, and social justice. In contrast to Western legal systems that emphasize punishment alone, Islamic jurisprudence incorporates moral and spiritual rehabilitation into its legal system.

Offenses like theft and adultery, which attract Hudood penalties, can be reduced by sincere repentance and reform. This is a principle that finds support in contemporary concepts of restorative justice, where the focus is on forgiveness, rehabilitation, and reintegration into society instead of extreme retribution. Islamic criminal law therefore presents a distinctive approach which reconciles punishment and mercy, enabling individuals to be redeemed and reintegrate into society.

In summary, Islamic law is a robust and versatile legal system that governs different aspects of human existence, ranging from finance and trade to family and criminal justice. Its ethics-based principles of justice, equity, and social responsibility continue to inform modern-day legal discourse, providing a moral and equitable alternative to traditional legal systems. The continued development of Islamic jurisprudence underscores its potential to respond to contemporary challenges while remaining closely tied to its source materials.

View the CSS Muslim Law & Jurisprudence paper 2025

You can also visit the CSS Notes, all CSS previous papers.