The Finance Department of Punjab issued a Notification of New GP Fund Subscription Rates 2022 on October 17, 2022. The new rates are effective due to the Revised Pay Scales 2022 for the employees of BPS-01 to BPS-22.

New GP Fund Subscription Rates 2022 for Punjab Employees

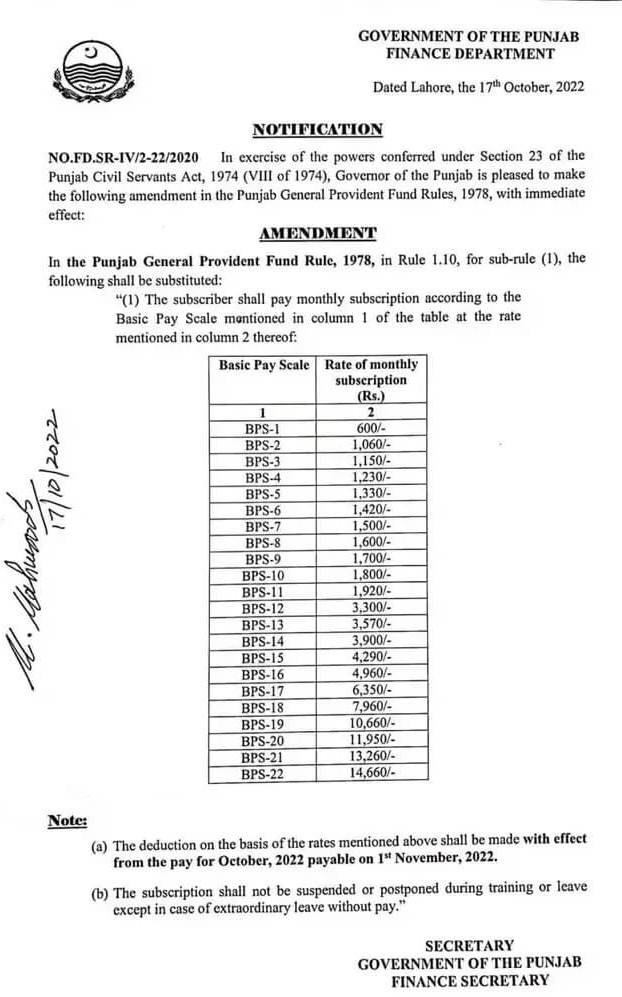

According to Section 23 of the Punjab Civil Servants Act, 1974 (VIII of 1974), the Governor of Punjab is pleased to make the following amendment to the Punjab General Provident Fund Rules, 1978, with immediate effect:

Revised Amendment

In the Punjab General Provident Fund Rule, 1978, in Rule 1.10, for sub-rule (1), the following shall be substituted:

(1) The subscriber shall pay a monthly subscription according to the Basic Pay Scale mentioned in column 1 of the table at the rate mentioned in column 2 thereof:

Table of Revised General Provident Fund Rates 2022 for Punjab Employees

| Sr. No | Basic pay Scale Number | Rate of Monthly GP Fund Subscription |

| 1 | BPS-01 | Rs. 600/- |

| 2 | BPS-02 | Rs. 1,060/- |

| 3 | BPS-03 | Rs. 1,150/- |

| 4 | BPS-04 | Rs. 1,230/- |

| 5 | BPS-05 | Rs. 1,330/- |

| 6 | BPS-06 | Rs. 1,420/- |

| 7 | BPS-07 | Rs. 1,500/- |

| 8 | BPS-08 | Rs. 1,600/- |

| 9 | BPS-09 | Rs. 1,700/- |

| 10 | BPS-10 | Rs. 1,800/- |

| 11 | BPS-11 | Rs. 1,920/- |

| 12 | BPS-12 | Rs. 3,300/- |

| 13 | BPS-13 | Rs. 3,570/- |

| 14 | BPS-14 | Rs. 3,900/- |

| 15 | BPS-15 | Rs. 4,290/- |

| 16 | BPS-16 | Rs. 4,960/- |

| 17 | BPS-17 | Rs. 6,350/- |

| 18 | BPS-18 | Rs. 7,960/- |

| 19 | BPS-19 | Rs. 10,660/- |

| 20 | BPS-20 | Rs. 11,950/- |

| 21 | BPS-21 | Rs. 13,260/- |

| 22 | BPS-22 | Rs. 14,660/- |

Important Note

- The deduction on the basis of the rates mentioned above shall be made with effect from the pay for October 2022 payable on 1st November 2022.

- The subscription shall be suspended or postponed during training or leave except in case of extraordinary leave without pay.

Decrease in Net Salary of Employees

With the effect of this, notification, the employee of Punjab will receive the salary on 1st November 2022 with revised GP Fund deduction rates.

In this way, they will get less salary on 1st November 2022. However, the GP Fund deducted amount is the employee’s personal amount. They can withdraw the same when they needed. In simple words, there’s no restriction on any employee regarding utilizing its GP Fund. The rules for obtaining GP funds during service will remain the same. The only deduction amount is increased.

View the Notification of New GP Fund Subscription Rates 2022 on October 17, 2022

You may also like these:

- Notification of Revised Basic Pay Scales 2022 AJK

- Notification for Grant of Time Scale BPS-1 to BPS-16 of Federal Government

- Punjab Rescue (1122) Risk Allowance 2022

- How to Get Salary Slips for Government Employees Online