In an effort to make the tax payment process more convenient for the tax payers, the Federal Board of Revenue (FBR) has introduced a new e-payment option on the IRIS portal allowing the direct payment of taxes through the said portal. The object of this new feature is to make it easier for taxpayers to create challan and pay taxes.

Step-by-Step Guide to Using the New E-Payment Feature

To use this new feature on IRIS website please follow the step by step guide:

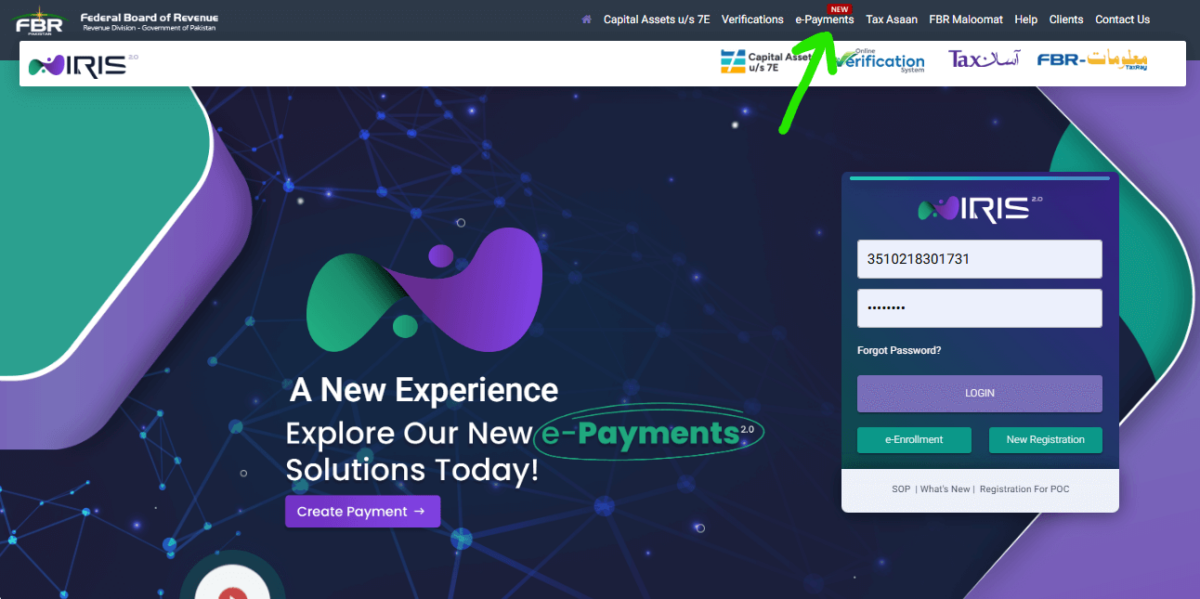

Step 1: go to iris.fbr.gov.pk/login and click on the e-Payments menu.

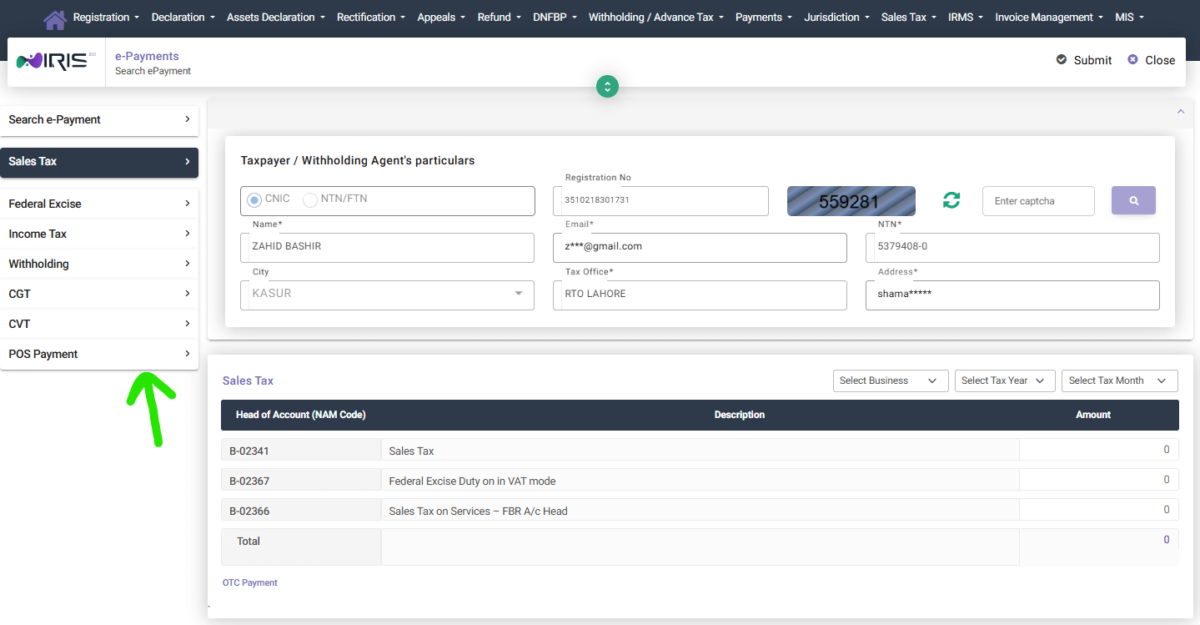

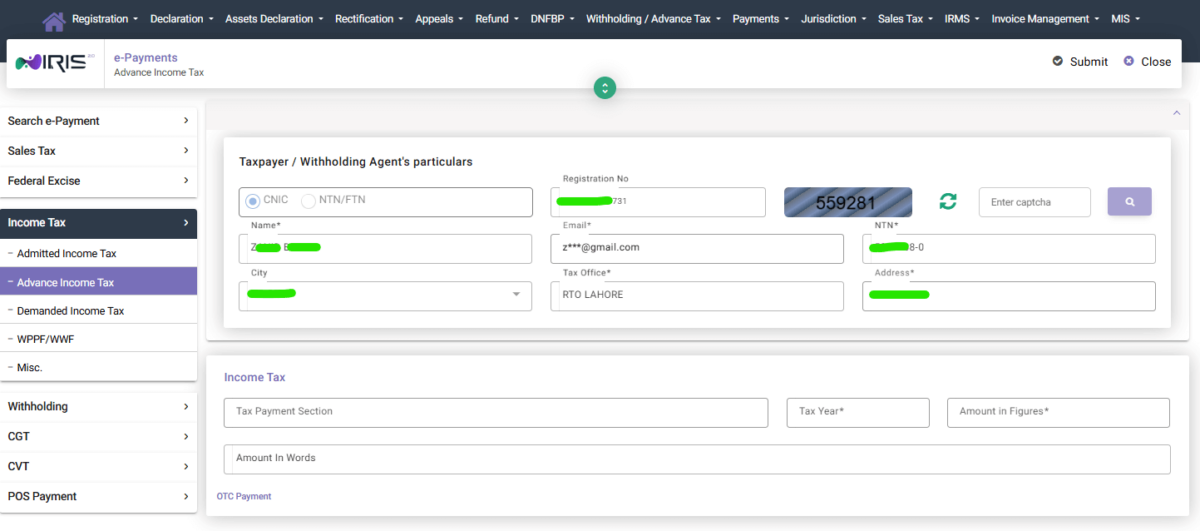

Step 2: Select the type of tax you need to pay for example, income tax, sales tax, withholding tax, Federal excise duty and POS payment.

Step 3: Enter the required details, such as the payment amount, the tax period, and any applicable reference numbers.

Step 4: choose your preferred payment method to make payment.

Step 5: make the payment as soon as possible. The PSID created through this process will remain valid for 30 days.

Step 6: once you submit the payment you will be receive a message confirming your payment on your email and registered mobile number.

So this is how you can use this new feature of e-Payments on IRIS website for making the challan and submission of taxes. If you have any question you can ask them in the comment section below.

Also read:

- Common Income Tax Return Mistakes to Avoid in Pakistan

- How to Make NTN in 2023 for Salary and Business

- Income Tax Return Course in Pakistan

that is really a good step.