If you have forgotten your FBR IRIS password, do not worry. Many people are disappointed when filing tax returns or checking tax details. Resetting an IRIS password is easy and simple. I will guide you through the process of recovering the password step by step. Whether you are a salaried person, business owner, or tax consultant, this process will help you recover your account.

FBR’s New Password Expiry Policy

The password has an expiration date of 60 days as per the new requirements of FBR. Therefore, you need to change your password every two months to secure your account. This policy will also prevent possible dangers from stale passwords and adhere to current cyber-security practices. Thus, monitoring such changes is very crucial so that one does not get locked out of his/her account.

How to Reset Your FBR IRIS Password

If you remember your old password, resetting it is a very simple process. Follow the below steps:

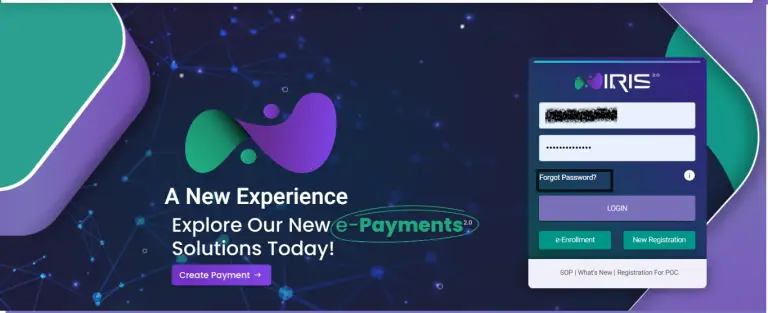

Step 1: Log in to the FBR IRIS website

- Visit the official FBR website and navigate to the login page.

- Enter your NIC and current password to access your account.

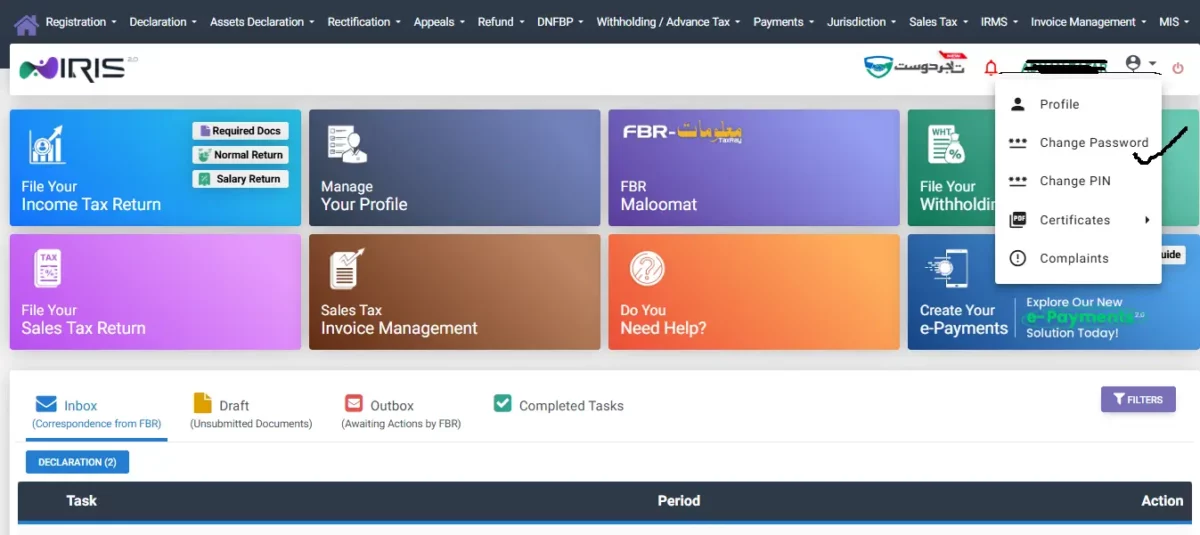

Step 2: Password Reset Option

Once you log in, go to the settings or account management section. Select the option to change or reset your password.

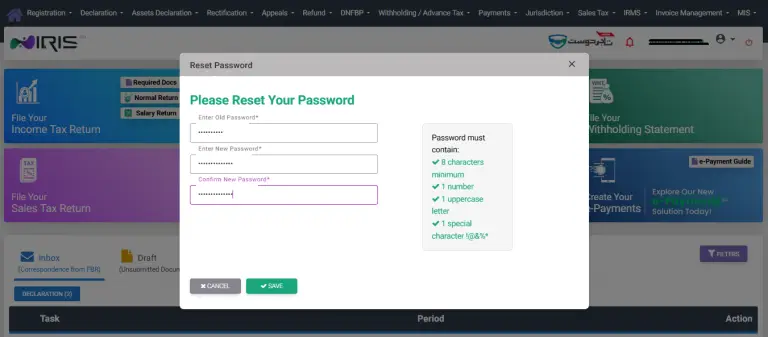

Step 3: Enter Your Current Password

You will be asked to enter your existing password. This step verifies your identity.

Step 4: Create a New Password

- Enter a strong new password that adheres to FBR’s password guidelines.

- Confirm the new password by entering it again.

Step 5: Save Changes

- Submit the new password to update your credentials.

- A confirmation message will appear that your password has been successfully changed.

Steps to Follow If You Have Lost Your Password

If you’ve forgotten your FBR IRIS password, follow these steps to reset it:

Step 1: Go to the Login Page

- Navigate to the FBR login page.

- Click on the “Forgot Password” link.

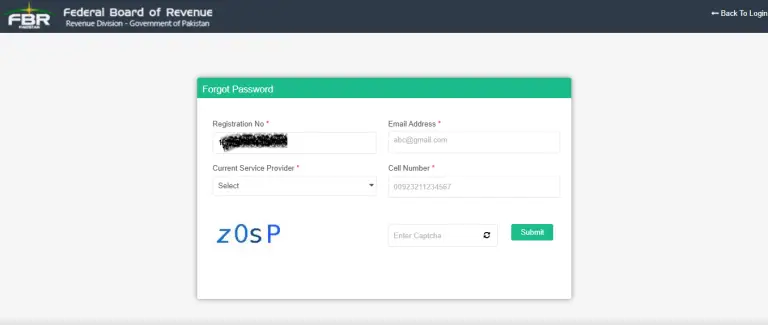

Step 2: Provide your NIC

- Enter your registered NIC.

- Registered Phone Number with name and network name.

- Verify the captcha code

- Click on the submit button.

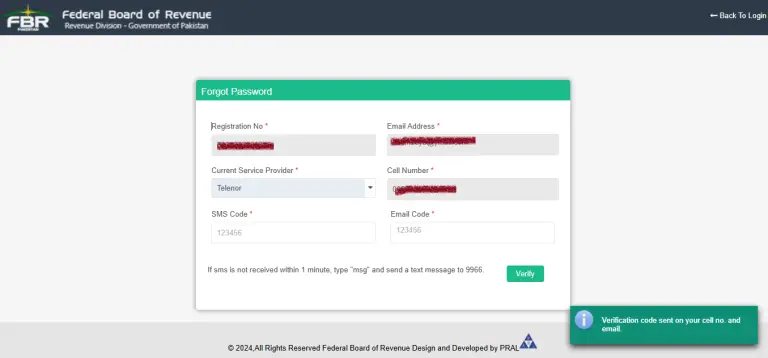

Step 3: Receive Confirmation Codes

After that, you will receive confirmation codes at your given Email address and Phone Number.

Step 4: Enter Verification Codes

Now enter the codes you have received in the password recovery page and click verify.

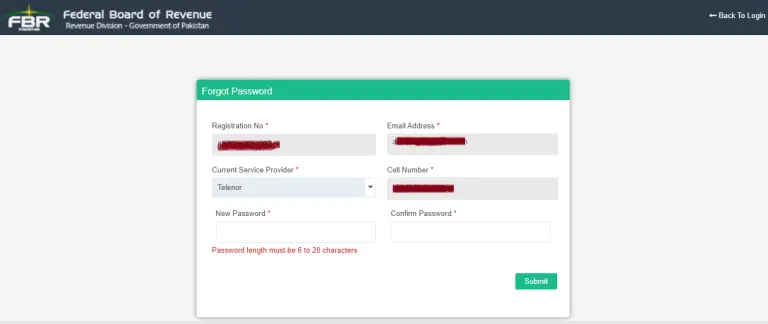

Step 5: Set a New Password

- Once verified, you will be asked to create a new password.

- Enter and submit your new password.

Manual Password Recovery through the Regional Tax Office (RTO)

If you are unable to reset your password online, you can manually reset it by visiting your Regional Tax Office (RTO). There you have to follow these steps:

Step 1: Visit the RTO

Go to the RTO in your region along with your identification documents, such as your CNIC.

Step 2: Submit an Authority Letter (If Applicable)

- If you are unable to visit the RTO yourself due to illness or being out of the country, you can authorize someone else to act on your behalf. This is called a legal representative.

- Write an authority letter mentioning the name and details of the person you are authorizing to visit the RTO.

- Sign the authority letter and attach a copy of your identification document.

Step 3: Provide Updated Contact Details

Ensure you have given the updated and correct email address and mobile number for your profile.

Step 4: Complete the Update

Once your email and mobile number are updated in the system, you can reset your password online from anywhere.

How to Update Your Email and Mobile Number in the FBR Profile

To ensure complete password recovery and account management, it is essential to keep your registered email and phone number up to date. Follow these steps to update your profile:

- Log in to Your FBR Account: Use your current credentials to log in.

- Access the Profile Section: Go to the “Profile” or “My Account” section from the dashboard.

- Edit Personal Information: Locate the fields for email address and mobile number. Update these fields with your current contact details.

- Verify Changes: Save the changes. FBR may send a verification code to your new email or mobile number. Enter the verification code to confirm the update.

- Save and Confirm: Once it is verified, your updated information will be reflected in your profile.

Know Your FBR Profile

Your FBR profile contains critical information about your tax and financial activities. It is important to review and maintain accurate details to avoid discrepancies. The profile typically includes:

Personal Information: Name, address, and contact details

Bank Details: Account numbers and associated banks

Source of Income: Employment, business, or other income streams

Registered Businesses: Details of any businesses which is registered under your name

Keeping this information accurate ensures smooth interactions with FBR’s online system, whether for tax filing, business registration, or accessing related services.

Conclusion

Changing your FBR password and keeping your profile updated is important to keep your account safe. A strong password protects your information, and correct contact details make it easy to fix login problems. As per the new policy of FBR, you need to change your password once in 60 days. Check your account often to stay safe and follow the rules.

Also Read

- Income Tax Return Course in Pakistan

- How to Make an NTN Number in Pakistan?

- FBR Exempts Overseas Pakistanis from Advance Tax on Property