The Federal Board of Revenue (FBR) has introduced a simplify method of filing complaints about income tax return, sales tax return and other similar issues within IRIS portal. If any person has a complaint he can submit directly to the FBR from IRIS portal. This is a very easy and simple method and in this article, you will learn about this complaint feature of FBR IRIS in detail. You will learn how to file complaint in FBR.

New Feature of Filing Compliant in FBR

Before 2021 if any taxpayer has a complaint about the service or tax issue he personally visit to the local FBR office and then he file his complaint. See this was a very long and uncomfortable method. During 2021 tax year FBR launch this new complaint feature inside IRIS portal to facilitate the taxpayer regarding their complaints. This new feature of filing complaints in FBR has now so much importance. Taxpayer from around the country can use this feature online and they don’t have to visit the office personally.

How to File Complaint in FBR IRIS Portal

You can file your complaint about income tax or sales tax by following these steps:

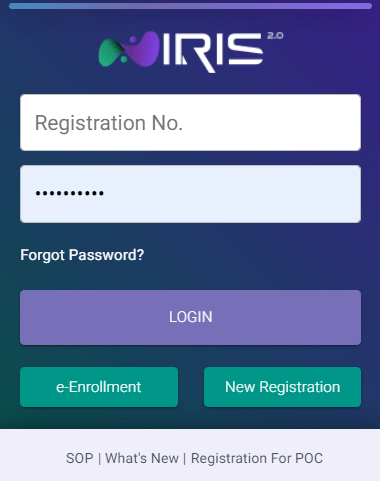

Step1: To get started with filing online complaint in FBR IRIS portal first you need to sign in with your NIC and password.

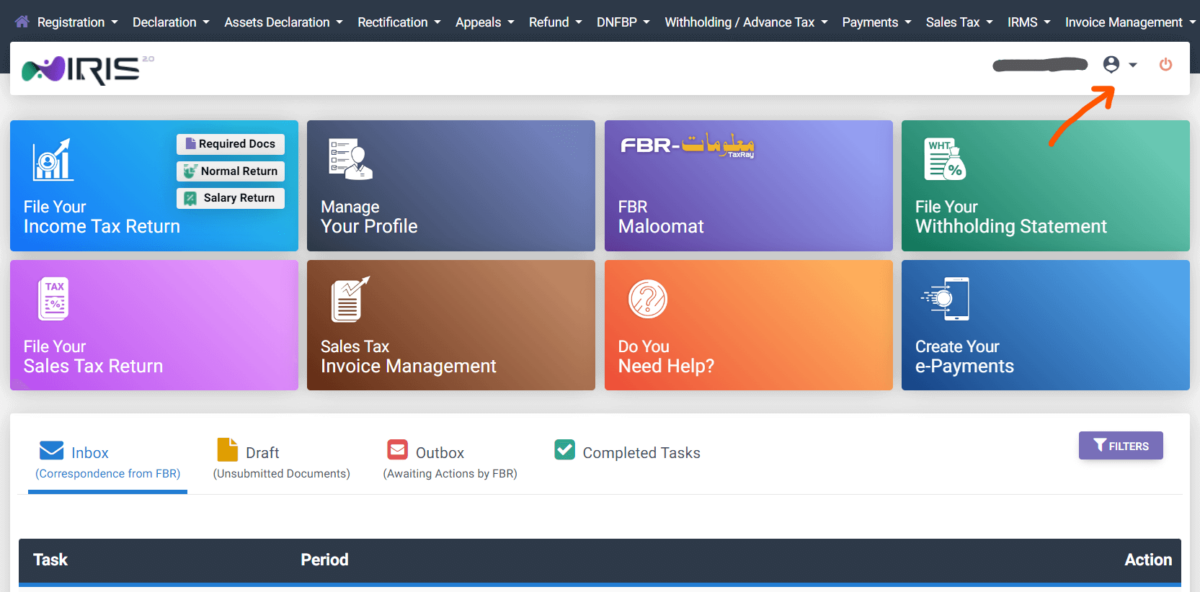

Step 2: After sign in and from your “dashboard” you need to click on your profile icon.

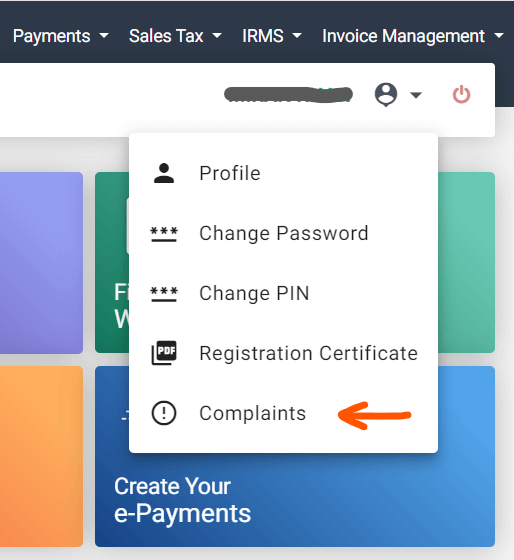

Step3: In profile options here you will click on the “complaints” option.

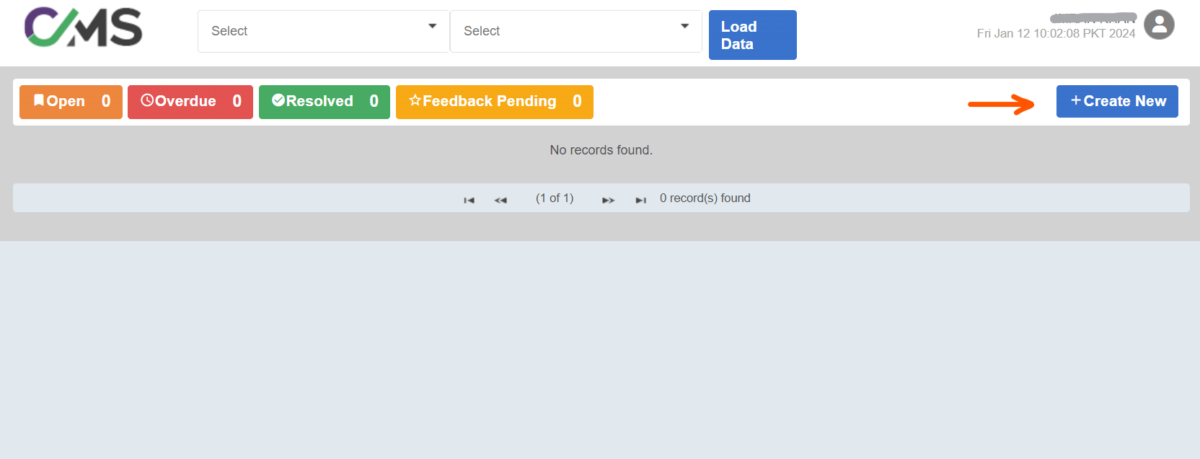

Step 4: When you click on “complaints” option a new window will show up and here you will start your complaining procedure.

First you need to click on this “Create New” button to open the complaint form.

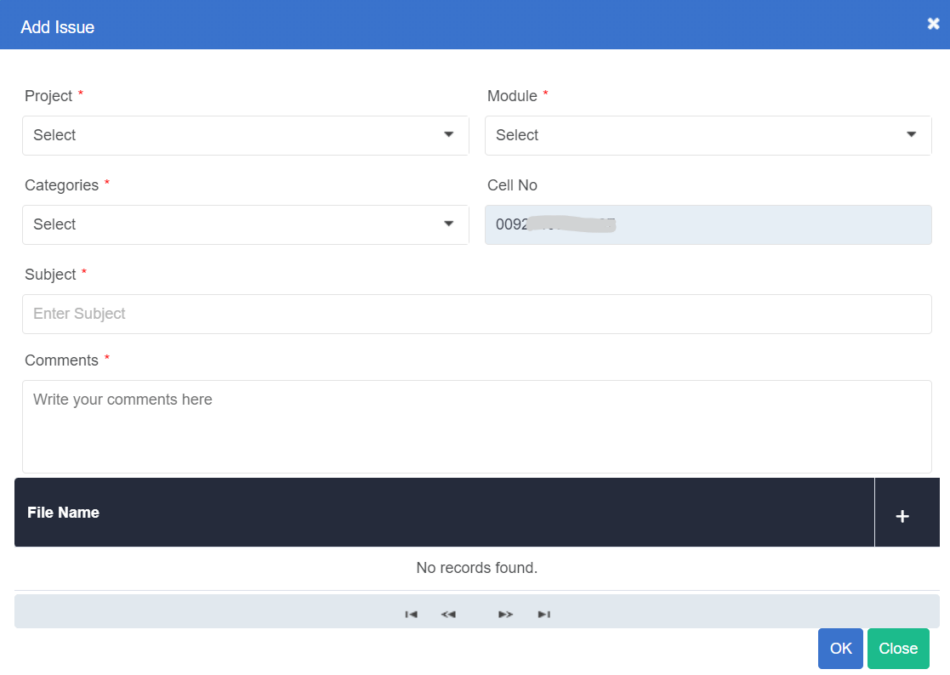

Step 5: In this complaint first you need to select the project of FBR against which you need to file your complaint.

After selecting module and category of the module you can simple enter the subject of your complaint, i.e. “My payment is stuck”.

Below this you find a “comments” section in which you have to explain your whole issue with details. You need to be as clear as possible so that FBR find your complaint important and reply you soon.

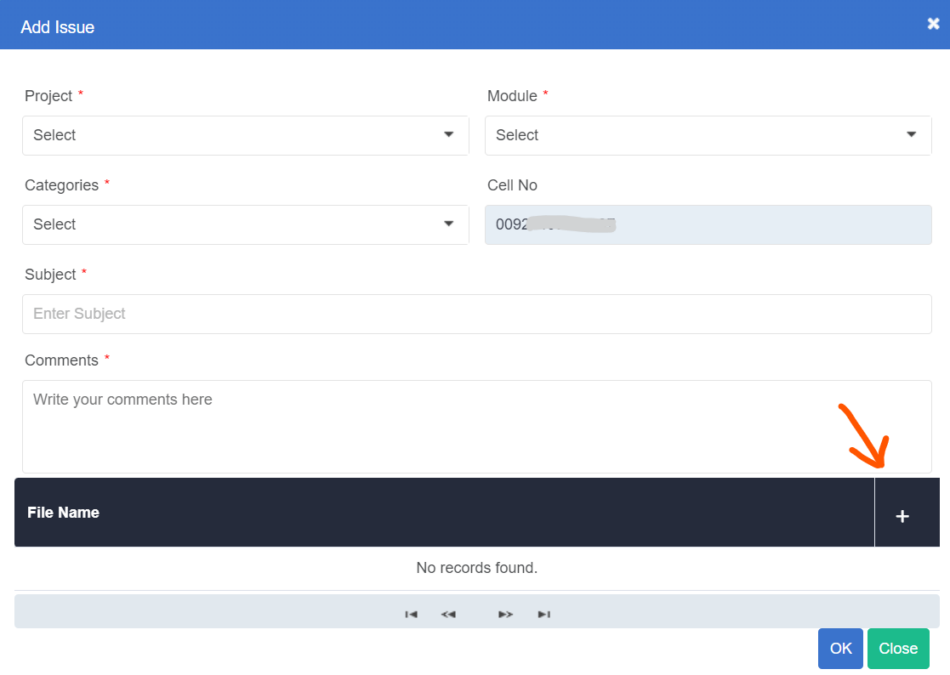

Step 6: When you explain your issue well it is also important to attach your necessary proof or document if you have. It will give good impression and make your complaint more relevant.

To upload your document you need to click on this plus icon and then attach your file. Remember, you can only upload document in PDF format.

After attaching the document, click on this “Ok” button to submit your complaint to FBR.

FBR will now take up the case and give you reply in a course of time. During this time you need to visit your complaint section time and again. If you satisfy with FBR reply then you can close your complaint. But if you still have concerns then you start a new complaint again.

You can also watch this video guide on how to submit complaint to FBR about income tax or sales tax.

So, that’s it this is how you can file your complaint to FBR inside IRIS portal.

If you like to Learn about Income Tax Return Filing Method then you can enroll in our Tax Return Master Course.

If you like this article then you must like these following articles too:

Also Read:

- How Section 114B of the Income Tax Ordinance Impacts Taxpayers in Pakistan

- How to Make NTN in 2023 for Salary and Business

- Understanding Section 7(e) of Income Tax Ordinance 2001

- How to become Active Tax Filer in 2024