FBR has updated its IRIS dashboard. FBR has given a facility to all taxpayers to check their assets and taxes detail inside the IRIS dashboard. This service is called “FBR Maloomat”. In this article, you will learn how to check your assets and taxes details online.

Let’s get started!

Check your Assets and Taxes details Online

The tax authority has provided taxpayers with the FBR Maloomat facility to check their tax information. Further, from the FBR Maloomat tab a citizen can really look at the duty derivations/installments made by him or by an expense-keeping specialist.

Before the FBR Maloomat section, a taxpayer has to access this portal separately. Now, this facility is available to all taxpayers across the board. In this Maloomat section, you can check your tax details, payments, and tax deduction during a financial year. You can also check your property, vehicle, and other assets owned by you.

Below I have given a step-by-step procedure to check your assets and taxes details online with the help of FBR Maloomat.

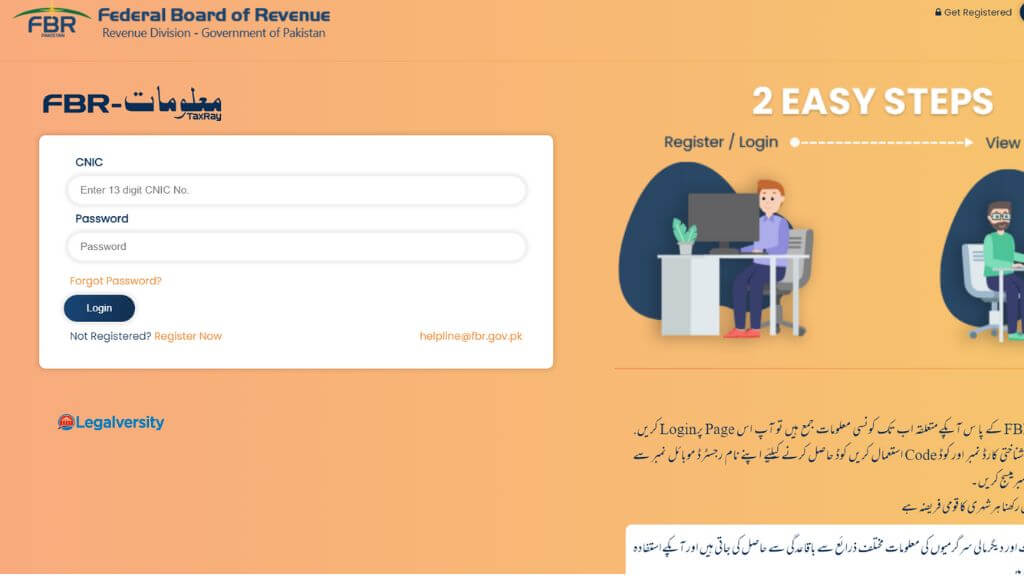

Step 1: Open the FBR IRIS website

Step 2: Enter your CNIC and password to log in

Step 3: Click on the “Maloomat” menu in the main navigation

Step 4: inside “Maloomat” you’ll find a sub-menu tab “Assets & Expenses from third party sources” click on it

Step 5: FBR “Maloomat” portal will be opened

Step 6: in FBR “Maloomat” you can see your assets and taxes detail, credit and debit card details, and your properties, and vehicles. If you wish you can download this data by clicking the “download” next to the given data.

For your guidance, I have given both the new and old themes of the FBR website so that you can have a better idea.

How unregistered person can access FBR Maloomat?

If you are not registered with FBR, you can access the FBR Maloomat portal by following the steps below:

- Go to the FBR website

- then, on the left, click the “FBR Maloomat” tab.

- This will open a new window with the name “FBR Maloomat.”

- Now, on the right, click the “Get Registered” tab.

- Fill out the registration form with the information required; submit it; enter verification codes from your phone and email; submit.

- It will give you your FBR login and password.

- Use these login details to access your FBR tax information from the FBR Maloomat portal

If you wish to learn in detail about Income tax return method then must enroll in this Income Tax Return Master course.

Also Read:

- How to Claim Tax Refund from FBR

- FBR Tax Asaan App Review: Features and Benefits

- How to File Income Tax Return in 2022

- How to File Application for Extension in Date for Filing of Income Tax Return