In this tutorial, you will learn How to File an Application for an Extension on the Date for Filing of Income Tax Return. Filling the Application for Extension in Date for Filling Income Tax Return is very simple. But before that, you must understand why you need to file an application for an extension. When you find that your annual return is not completed and you are lacking sufficient data for filling the Income Tax Return, then you can file an application for an extension on the date for filing the income tax return. There may be some other reasons also that can be a reason for filing the application for extension.

You can also enroll in our Income Tax Return Master Course 2022 by pressing the apply now button.

Application for Extension in Date for Filling Income Tax Return

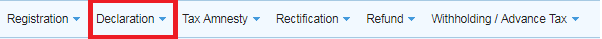

To file an Application for Extension in Date for Filling Income Tax Return, first, you need to login into your IRIS portal. You can log in by simply putting your CNIC and password. After logging click on the “Declaration” tab on the menu at the top of the screen.

When you click on the declaration tab a drop-down menu will appear. In the drop-down menu Select “119(1) / 114 (Application for extension in time for filing of Return of Income)“.

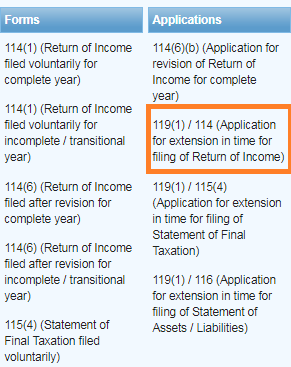

On the next screen, you have to click on the “Period” button and select the relevant year.

When you click on the period button a Tax Periods list will appear. Now Click on the “select” link shown against the tax period.

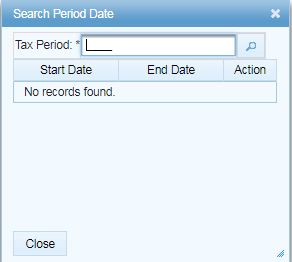

After that, a whole new form will open up and in this form, you must the reason for File Application for Extension in Date for Filing of Income Tax Return. Explain your reason wisely in the contents box down there.

When you write down your reason in the content box Click on the “Submit” button on the menu at the top of the screen. After that click on the “Print” Button on the menu at the top of the screen to get a print of the application.

Please note that Your application shall be forwarded to the relevant Tax Office and when the concerned officer passes an Order on your application, the order will be available in your Inbox on the IRIS portal.

Conclusion

Filling an Application for Extension in Date for Filing of Income Tax Return can be done through form 119(1) / 114 (Application for extension in time for filing of Return of Income) available in the IRIS portal.

You may also like these:

- Filer and Non-Filer Tax Rates in Pakistan – Benefits of Becoming Tax Filer

- How to File Income Tax Return in 2020?

- How to Change Personal Details, Name, Address in NTN?

- How to Make NTN Number in Pakistan?

very good