Tax Rates on Bank Profit in Pakistan (2025-26)

The Finance Act 2025 has introduced a major change in the tax treatment of profit on bank deposits and other debt instruments. This amendment directly…

The Finance Act 2025 has introduced a major change in the tax treatment of profit on bank deposits and other debt instruments. This amendment directly…

The CSS Pakistan Affairs Paper 2026 is a compulsory paper that tests a candidate’s understanding of Pakistan’s ideological foundations, constitutional development, internal and external challenges,…

The CSS General Science & Ability (GSA) Paper 2026 is a compulsory paper in the CSS Competitive Examination and is often considered a scoring yet…

The English (Precis & Composition) paper is a compulsory and one of the most decisive papers in the CSS competitive examination. Here, you will find…

The English Essay is a compulsory and one of the most decisive papers in the CSS competitive examination. Here, you will find the CSS English…

The Finance Act, 2025, has brought long-awaited relief for full-time teachers and researchers in Pakistan by reviving the 25% tax rebate that had been withdrawn…

Executive Summary: Private/Public Companies Limited by Shares are the default and overwhelmingly preferred corporate form in Pakistan because they ring-fence members’ personal assets and are…

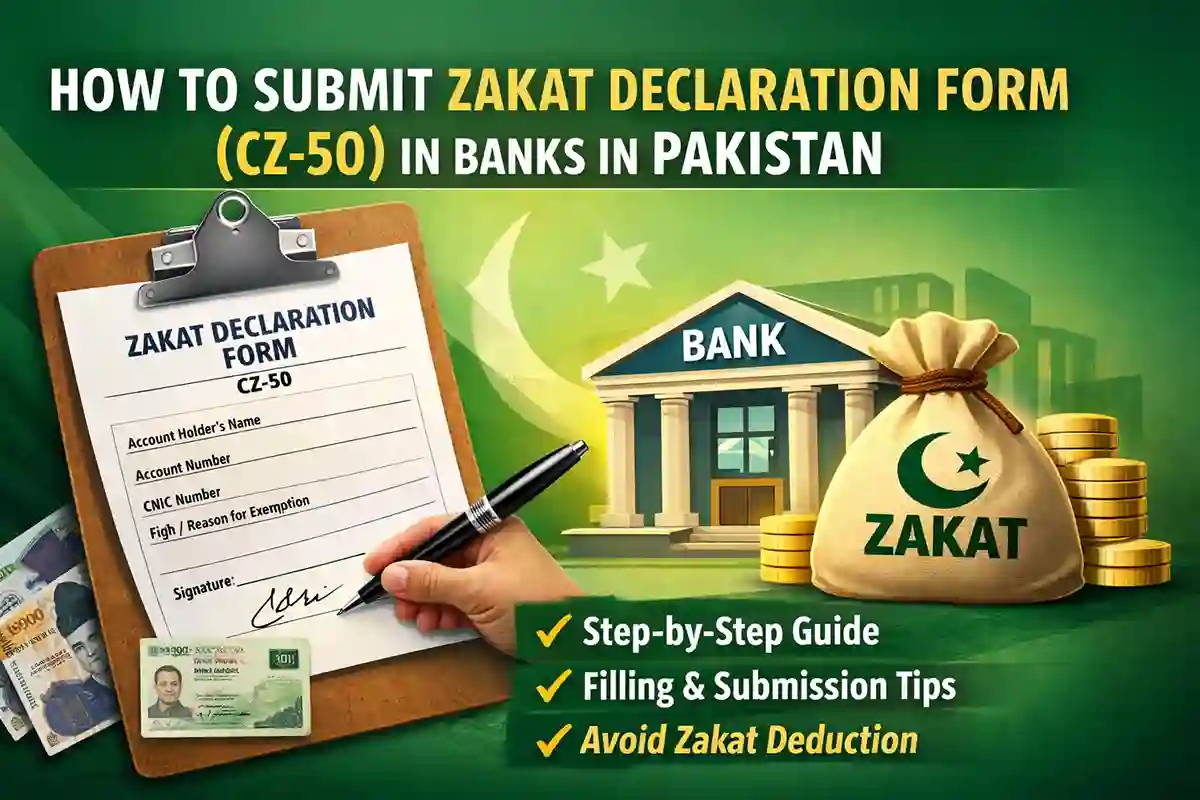

Zakat is an important religious obligation in Islam, but not all types of wealth are subject to compulsory Zakat deduction by banks. In Pakistan, the…

A trademark protects your brand name, logo, or slogan from being copied. In Pakistan, registering a trademark gives you legal ownership of your brand. It…

Psychology is the scientific study of human behavior and mental processes. Over time, psychologists developed different schools of thought to explain why humans think, feel,…