If you want to learn Income Tax Return filing in Pakistan for all types of categories—such as salary, business, freelancers, non-residents, insurance agents, service providers, and traders—then this Income Tax Return Master Course is the perfect learning program for you.

Legalversity, one of Pakistan’s most-viewed YouTube channels for tax-related education, is offering a complete and practical Income Tax Return Master Course. In this course, you will learn the latest FBR IRIS system, NTN creation, tax return filing, challan generation, wealth statements, and everything required to become an expert tax consultant.

After learning these skills, you can easily file your own return and earn a handsome income by filing returns for others.

Legalversity, the most viewed YouTube channel about Income Tax Returns, is offering an Income Tax Return Course. This course will teach you about updated Tax Return filing methods for all categories. By becoming a complete income tax return expert, you can earn a handsome income.

Who is this Course For?

This Income Tax Return Master course is for every citizen aged 18 and above, and for those who want to become experts in Income Tax return filing. This course is ideal for:

- Students from the Pakistani NIC

- Salaried persons

- Business individuals

- Freelancers and service providers

- Non-resident Pakistanis

- Insurance agents

- Shopkeepers and traders

- Anyone who wants to become a professional tax return filing expert

After completing the course, you will be able to file your own tax returns and offer tax filing services professionally.

What Will You Learn in This Income Tax Return Master Course?

In this practical and step-by-step tax filing course, you will learn:

- How to easily file your own income tax return

- How to earn money by filing tax returns for clients

- Complete the NTN creation process for all categories

- How to correctly fill out the 181 Registration Form

- How to update your tax profile in IRIS (US 114-A)

- Understanding all tax return types in Pakistan

- Creating and generating all types of FBR challans

- Editing and revising tax returns professionally

- Understanding tax limitations and different categories

- Complete method for Form 114(1) filing

- Solutions to common IRIS errors and problems

- Complete filing method for Wealth Statement (114(6))

- How to stay compliant with FBR without any help

- Become fully independent for all tax-related tasks

After completing this course, you will no longer depend on anyone else for tax matters — you will be your own boss.

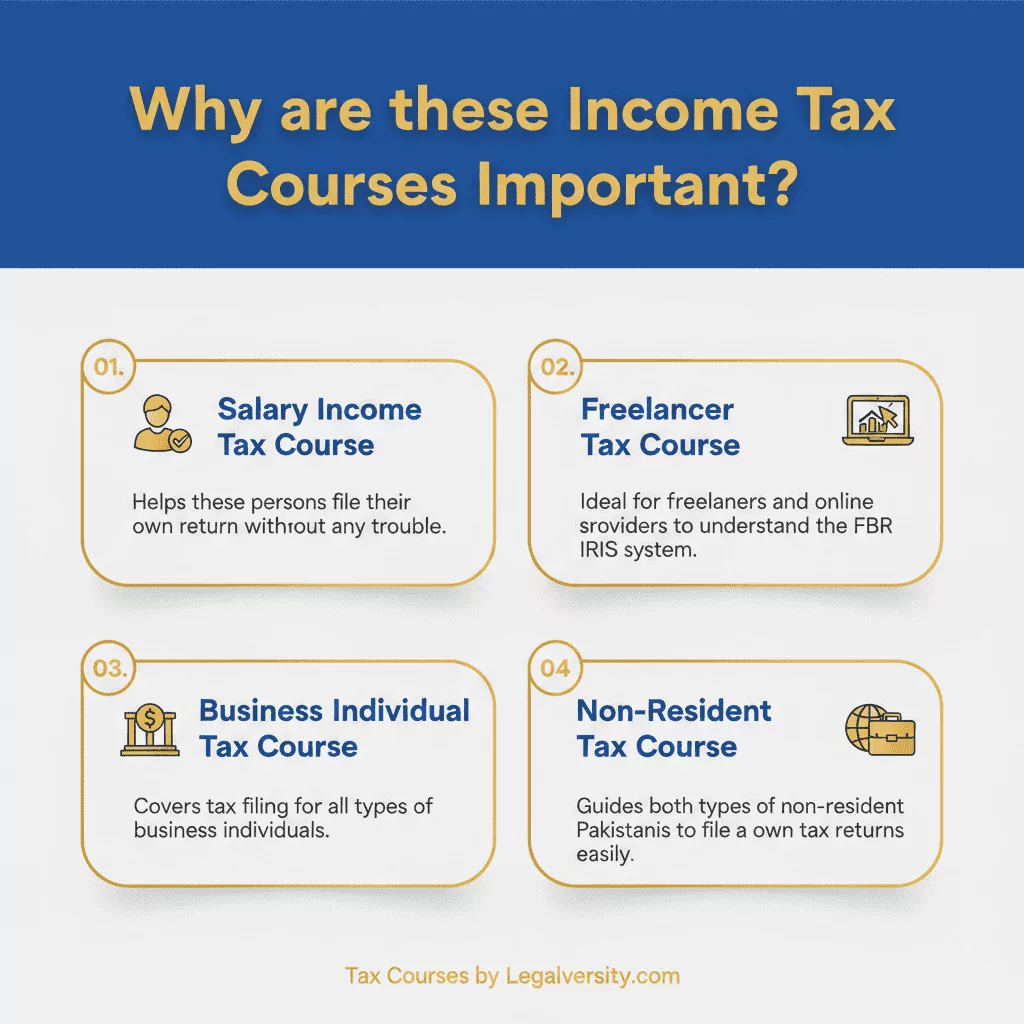

Why Is This Course Important?

This course is important because:

- Most people in Pakistan do not understand FBR procedures.

- Hiring a tax consultant is expensive for many people.

- Filing your own return gives you financial independence.

- Pakistan’s tax system is becoming more strict and digital.

- Skilled tax filers are in high demand across the country.

By learning tax filing, you can build a strong income stream while helping others become tax-compliant.

Course Details

After enrolling, you will get complete access to our practical video lessons and learning materials. All up-to-date according to the latest rules and income tax laws.

How to Access the Course?

- Download the Legalversity Courses App from the Play Store.

(iPhone users can access the course on our official website, syedtech.net) - After enrollment, you will receive your Login ID and Password via Email and WhatsApp.

Course Breakdown

| Sr. # | Course Name | Course Details |

|---|---|---|

| 1 | Business Tax Return | 37 practical video classes |

| 2 | Salary Tax Return | 27 practical video classes |

| 3 | Freelancer Tax Return | 32 practical video classes |

| 4 | Non-Resident Tax Return | 29 practical video classes |

| 5 | Complete Tax Return Master Course | More than 60 practical video classes including all categories above |

Master Course Content

If you want to learn Income Tax Return filing in detail, you can enroll in:

- Income Tax Return Master Course

- Salary Tax Return Course

- Business Tax Return Course

- Freelancer Tax Return Course

- Non-Resident Pakistani Tax Course

Each course includes step-by-step IRIS tutorials, practical examples, and recorded classes.

Duration of the Course

There is no fixed duration for this course. It is a self-paced learning program — you can complete it as fast as you want. We regularly update the course content according to FBR changes and new procedures.

How to Enroll in a Tax Return Course?

To enroll in this income tax return master course, click on the “Apply Now”. After that, you’ll receive a confirmation SMS on your Email and WhatsApp number.

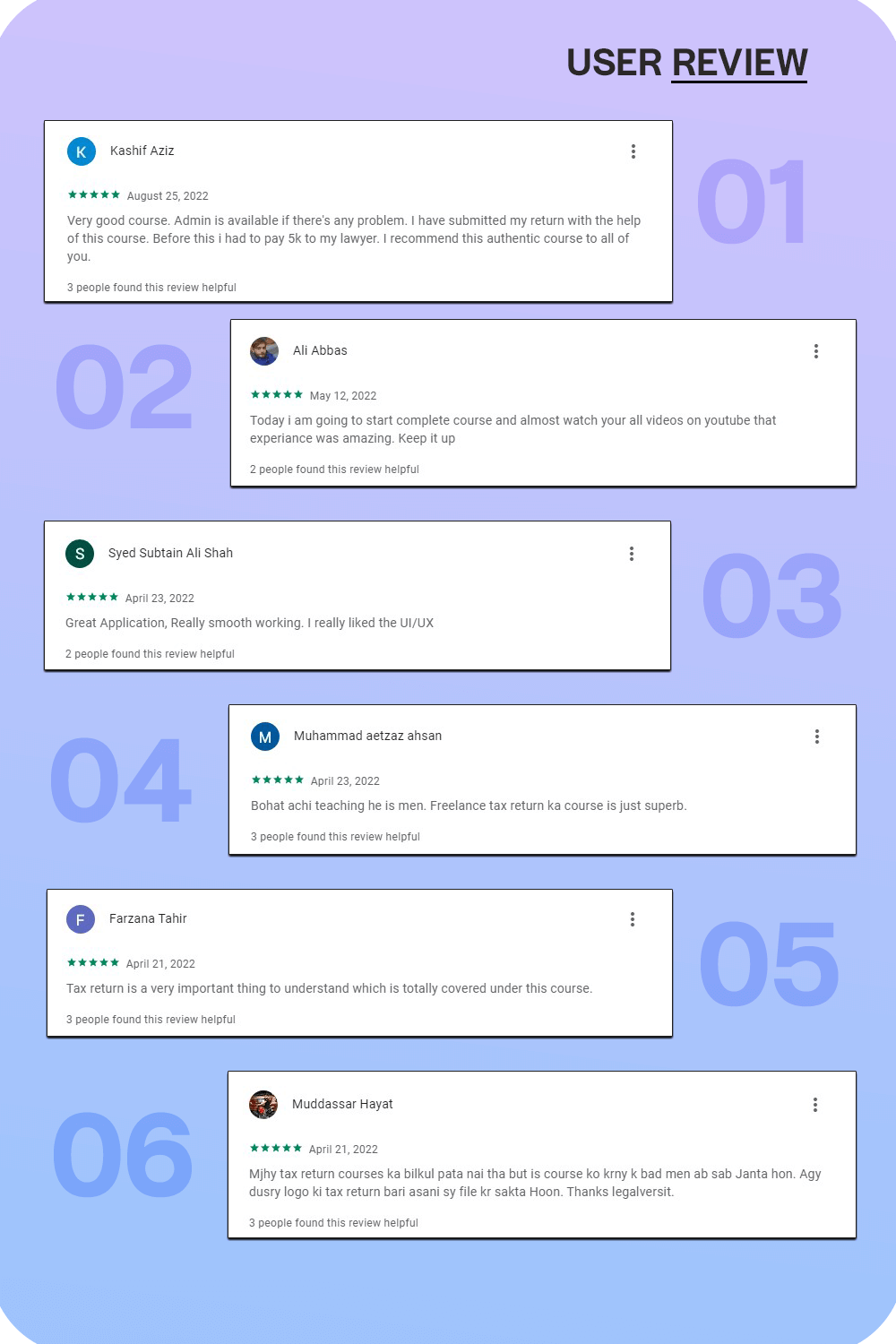

User Reviews about this Course

Hundreds of students have already completed this course and shared their successful experiences. You can check real user reviews on our Legalversity Courses App.

Have Any Questions?

If you have any queries, feel free to contact us:

- Facebook & Instagram: Send a message anytime

- Email: legalversity@gmail.com

We are always happy to help. Happy Learning!

How to cancellation of sales tax registration in FBR or PRA

Visit local FBR office for this and apply there for cancellation.

Please share complete details, including the fee for the Master Course. Is Sales tax return training covered by this course.

We have sent you an Email with details.

Interested plz send course details

Dear detail is given in this post. For other info than this, please contact us on our Facebook or Instagram pages.

I am interested

Share your whatsapp number or contact us on our Facebook or Instagram pages.

What is the fee of course?

کیا یہ کورس اردو میں ھے

g brother

What if my work shop commercial electric connection isn’t in my father’s name, it’s on previous owner name?

Jo is waqat usko deal kr rha jo usko pay kr rha wo dy ga. But koi contract hona chaye owner and tenant k darmiyan.

اس کیلئے موبائیل یہ کمپیوٹر ضرورت ہو گا

Is ke lia PC, Laptop ya mobile chahye.

Without b.com degree can I am tax consultant

Yes you can become. You should have knowledge of Rules and Procedure.

Interested

Apko email par sari information send kr di gai he. Kindly check your mail.

How can join?

Fee mathod plz

Dear brother please email us at legalversity.com. You have also been contacted on your email address.

Course fee detail?

Fees

Dear brother to see fee kindly visit this website: syedtech .net

I am interested

Dear brother please contact us on our facebook or instagram pages or email us at legalversity@gmail .com

I have read facebook post. Master course fee shown 2400 somthing. on completion of course either any certificate issued or otherwise. The 2nd thing is payment method of fee.

Payment Method is EasyPaisa or JazzCash.

Sir course fee kitni hy?

This course is so amazing. I recommend.

I have submit form but not response

kitna time lagta hai is course ko cover krny mein

yeh course krny ky bad mein tax return kr skty hoon

respected i want to knw, salary person business add krny k liy principal activity select krny k bd sales tax wala option b select kry ga kya? or sales tax select krn ya na select krn, dono sorton mn kya benifits ho ga kindly explain?

Dear brother a Govt. Salary person cannot do anything else that his job. Private person can do.

Is this course the latest? does this course cover all materials and IRIS functionality latest up-to-date 2024?

Yes brother. You can check the course content at syedtech.net

Okay brother i checked. It’s good but I don’t see content about late filing, replies or about main sections such as 181 penalty

Dear in 4 categories k bary men ye complete he and ye over time update bhi hota rehta he. So jo zarrori updates hoti hen wo add kr di jati hen.

Multiple times enroll kia ha but no response from your side

Dear apko Whatsapp par message kr dia gaya hoga. Jo may be ap ny na dekha ho.

No message received on whatsapp Yet..

Contact us on our Facebook or Instagram page. Facebook.com/legalversity and instagram.com/legalversity

Plz check your FB inbox

Many course karna hai

What is the course fee?

Go to Signup page to know: https://forms.gle/aVmtowk8bpdbWxyj6

Any fee or charge’s of course

Yes it has a nominal fee. Sign up here: https://forms.gle/GuMwJG6d1E4B5NCt5

I’m a retired officer from bank. Now I like to have some information in this field. My question is if I got registered in this course, what is the time limit to use this course to understand the procedure properly and if some one to clarify a point, to whom we will contact for?

There no limitation on the course. You’ll be given a WhatsApp number to ask questions if any.

AoA Sir,

My questions:-

1. The Master Course name as mentioned in your above “Course Details” will be consist from Sr. No. 01 to 05. ?

2. Kindly share total Fee detail & fee deposit method.

Sir charges of master course.either any office in rawalpindi

Salary return Tex fees & duration.online it

Dear brother it is for lifetime.

Is this is free ?

No brother there a nominal fee for each course.

I’m interested in master course and have already filled the form but not respond.

You have been contact on your WhatsApp number. Please email us your WhatsApp number if you haven’t already. Legalversity@gmail.com

If i chose complete course option, so i can learn all type or courses or any single

Yes you will learn all.

AOA. CAN YOU GIVE ANY CERTIFICATE ABOUT IT?

Is this course Online ?

Yes brother its an online course.

Will there be any online classes or only source of teaching is uploaded videos? And when ever we face any problem or couldn’t understand any topic in video then what is procedure to reach out to you for help.

what if fbr sends notice u/s 111(1) then how to respond?

What if someone take your master course and after some time he feel some difficulty in any matter, what type of support your registered student of master course can get.

Dear brother you will be given a number to contact at regarding your questions.

I got registration, and successfully filed my income tax returned 2021,2020, and also got learned many important things about income tax,

Thanks for your support

Thanks for your feedback.

I took this course 2 weeks ago. And I have learned a lot. Thank Legalversity for making such a course.

I’m interested in master course and have already filled the form but not respond.

Please I have fill the form and let me know what I have to do

Dear brother please contact us on our Facebook.com/legalversity page or Instagram pages.

Please accept my request

Sir kindly accept my request i have submit form.

Is course ma kn kn sa businesses ki return filling ki videos ho gi

Any certificate after the completion of course?

Sales tax ki classes hain isme??

Course fees Kia hai total

Mujhy iski poori details btay k master Course main ap Kya sikha rahy hain or kya overseas k related bhi all details hain mtlb unki return kaisy file krni hai each and everything Plz Reply as soon as possible

I have availed this course. It is just so informative. I recommend it to all.

Thanks brother for sharing your experience with us.

What is the fee of this course

Please fill up this form so you will know about the fee. https://forms.gle/9avneySX9Xs5WkG18

I want to learn sale tax return. Is there any course a available???

No right now only Income Tax is available. But you will find Sales Tax in Future.

AOA, i filled the form but i don’t receive any email. How i get the course?

You will get updated about the course shortly.

I learned tax returns from Legalversity’s YouTube channel. I really appreciate their work.

Thanks for your good words.

legalversity course krny k bad dusron ki tax return bhi file kr sakta hoon?

G bilkul isi lia to ye training course banaya he.

I took this course 3 days ago, and i am getting a great learning. thanks, legalversity

Thanks, brother. Keep learning.

tax return seekhan chahta hun apny lia taky men khud sy file kr sakun. form submit kr dia he.

You will get a response soon.

I got the online course about tax returns I must say it was so informative.

Thanks, Sister your words are highly appreciated.

I am a student of Legalversity youtube channel and know the teaching is perfect.

Thanks for your feedback.

Currently, I am going through this course. acha he kafi samjh aa rhi he cheezon ki.

Happy Learning sir.

hello, admin i have submit the form but i did not receive any message about how to access the course.

I have taken this course and it is so good. I have learned much.

Thanks for your feedback.