When you file your sales tax annual return; and if there is any amount that shows up in the refundable tax, you can claim it directly to your bank account. From the year 2020, the sales tax return procedure is made so easy. In this tutorial, you will learn how to File an application for a Sales Tax Refund. The Federal Board of Revenue (FBR) made the system fully automated and furthermore, it is not required any manual intervention.

The official of FBR said that the Sales Tax Refund procedure will be processed within 72 hours. If there are any issues found in your process the taxpayer will be through their registered email address or Mobile number.

You can also enroll in our Income Tax Return Master Course 2022 by pressing the apply now button.

How to access the Sales Tax Refund Portal?

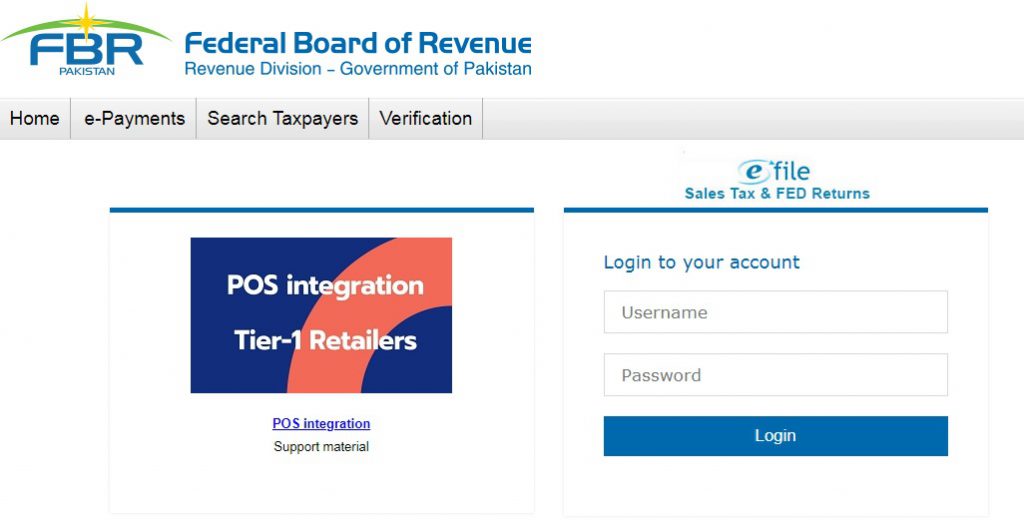

To access the e-FBR portal you can simply copy-paste this address () into your browser address bar and press enter. After that, the following login screen will show up:

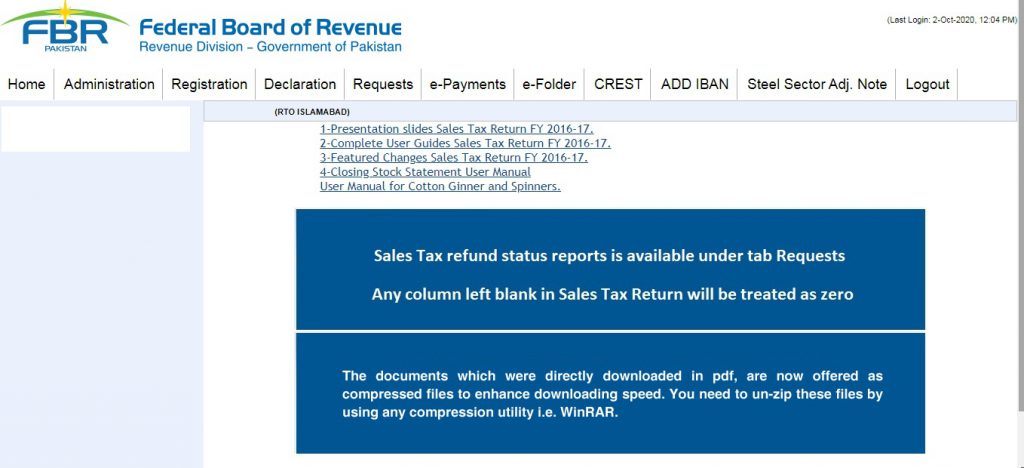

When the page load, please enter your login ID and password. After that the system will redirect you to a new page of e-FBR like you are seeing in the below image:

Here you should select Declaration for Sales Tax to file Annexure–H. After the year 2019, the FBR has made the process auto refundable and it is directly posted into your listed bank accounts.

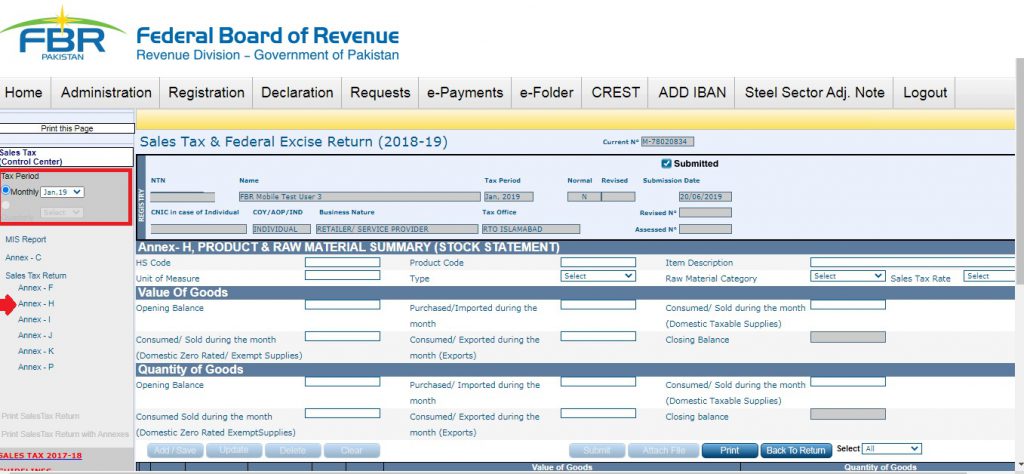

From the right-side panel, select the relevant tax year and click Annexure-H. After that the system redirects you to the Annexure-H page like the image shown below:

Conclusion

You should note that after filling out Annexure-H, the system will start your refund process. Filling out this Annexure-H form does mean that your refund is 100% claimed. The FBR will scrutinize your request and if they found it legitimate, your refund will be deposited into your bank account.

You may also like these:

- How to File Application for Extension in Date for Filing of Income Tax Return

- FBR Tax Asaan App Review: Features and Benefits

- How to File Income Tax Return in 2020?

- How to Register a Company in Pakistan | Private Limited Company Registration

good efforts