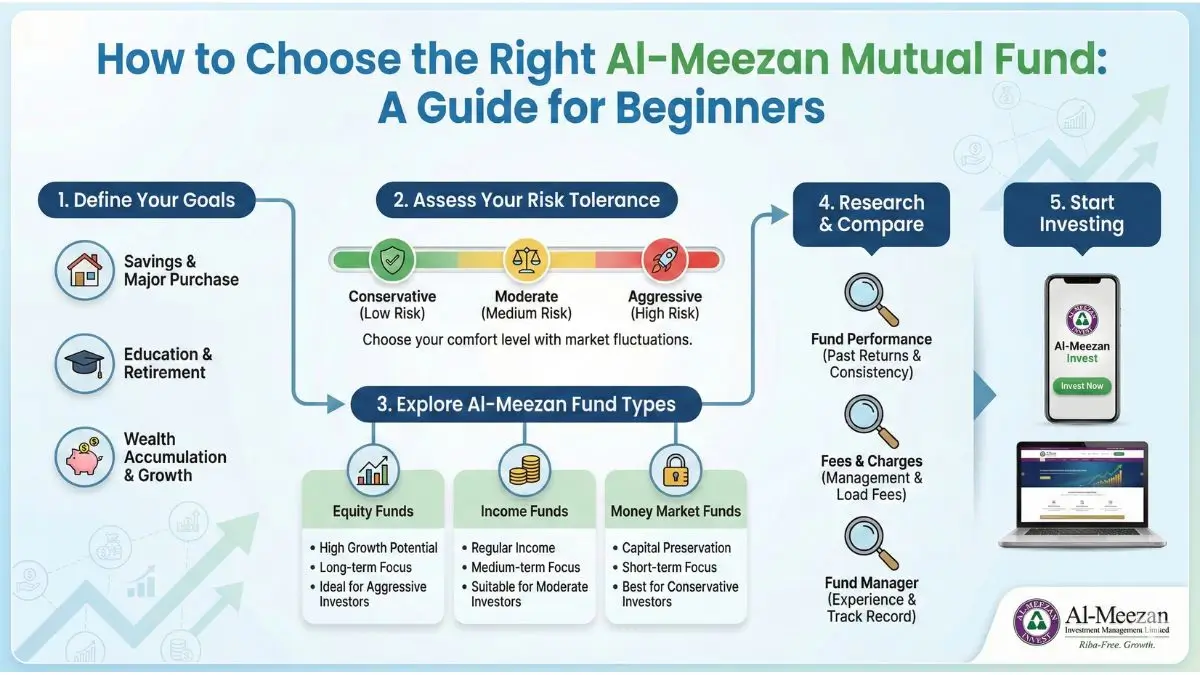

Many people want to invest in mutual funds. But when they visit Al-Meezan’s website, they see many different funds. This can be confusing. A normal person, who is not an expert, does not know which fund to choose. This guide will explain everything in simple words. No heavy terms. No complicated finance. Just clear steps.

Why Does Al-Meezan Offer Many Funds?

Every investor is different. Some want safety. Some want growth. Some want savings for retirement, children, or Hajj. This is why Al-Meezan created many funds. Each fund has a different purpose. Once you know your own goal, choosing a fund becomes very easy.

First Step: Understand Your Risk Level

You only need to answer one question:

How much risk can you take?

- If you want very low risk and peace of mind, then an Income Fund is best.

- If you can take medium risk and want better growth, then Asset Allocation funds work.

- If you want high growth and long-term profits, then an Equity (Stock) Fund is suitable.

That’s it. Just decide your comfort level.

Second Step: Decide Your Time Duration

Your fund choice also depends on how long you want to invest.

- If you want to invest for 1–2 years, stay in safe funds.

- If you want to invest for 3–5 years, choose balanced funds.

- If your goal is more than 5 years, growth funds give better returns.

When you combine these two things — risk level and time — the decision becomes very simple.

Third Step: Your Goal Matters

People invest for different reasons. Some want to build wealth. Some want to earn monthly income. Some want to save for their children or retirement.

So before selecting a fund, ask yourself: “What am I saving for?”

Your answer will guide you directly to the right fund.

Read more: Al Meezan vs MCB vs UBL — Which Mutual Fund Company is Right for You?

Understanding Al-Meezan Funds in Simple Words

Below is a simple breakdown of all major Al-Meezan funds in plain language.

1. Low Risk – Safe and Steady Funds

These funds protect your money. They don’t grow too fast, but they don’t drop much either.

Meezan Islamic Income Fund (MIIF)

This is the safest popular choice. It gives stable, halal returns. Beginners love it because it is easy to understand and easy to withdraw anytime.

Meezan Cash Fund

This is even safer. It works like a savings account for short-term money.

If you want low risk and peace of mind, MIIF is perfect.

2. Medium Risk – Balanced Growth Funds

These funds invest in both stocks and Sukuk. Not too risky, not too safe. They grow faster than income funds.

Meezan Asset Allocation Fund (MAAF)

This is a balanced fund. It is great for 3 to 5 years. It gives better growth but still manages risk carefully.

Meezan Balanced Fund (MBF)

This fund takes a little more risk and offers more growth.

These are good for people who want medium returns without too much tension.

3. High Risk – High Growth Funds

These funds invest mostly in the stock market. They give the best long-term returns, but they go up and down in the short term.

Meezan Islamic Fund (MIF)

This is the main stock fund. It is perfect for long-term goals like 7, 10, or 15 years. It grows your wealth the most.

Only choose these funds if you can stay patient during ups and downs.

4. Special Purpose Funds

Not every fund is for profit. Some are created for long-term saving and planning.

Meezan Tahaffuz Pension Fund (MTPF)

This is for your retirement. It builds a strong pension through monthly or yearly deposits.

Children Education Plan

This helps you save for your kids’ future education.

Meezan Hajj Savings Plan

This helps you save for Hajj with discipline and planning.

These plans are excellent when you have a clear goal in mind.

Which Fund Should You Pick as a Beginner?

If you are a beginner and want low risk, choose:

Meezan Islamic Income Fund (MIIF)

It is simple. It is safe. It is halal. It gives steady returns. And you can withdraw anytime. For most beginners, this is the best starting fund.

A Simple Decision Guide (Super Easy)

If you are still stuck, then choose from below:

- If you want low risk, choose MIIF.

- If you want medium growth, choose MAAF.

- If you want high growth, choose MIF.

- If you want retirement saving, choose MTPF.

With these four choices, you don’t need to think too much.