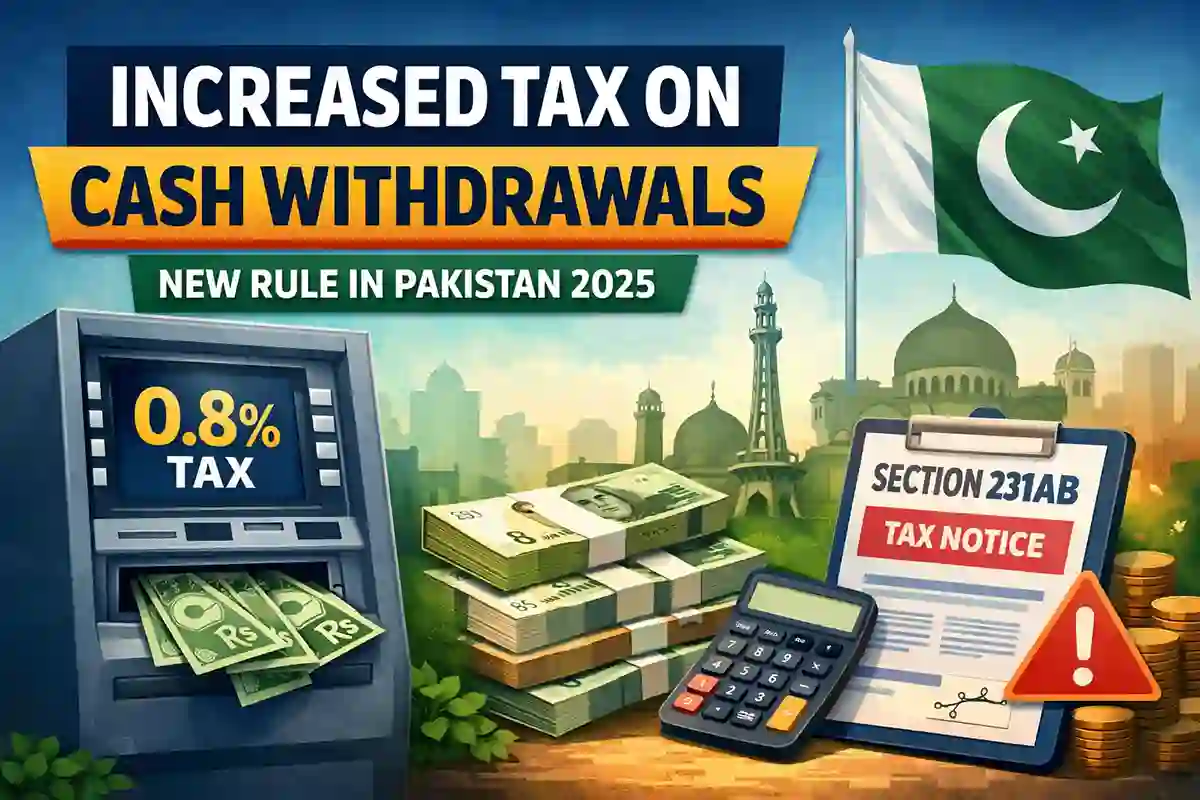

The Federal Board of Revenue (FBR) has updated the tax rule on cash withdrawals from banks. This change came through the Finance Act, 2025, and affects how much tax you may pay when you withdraw cash if your name is not on the Active Taxpayers List (ATL). The rule falls under Section 231AB of the Income Tax Ordinance.

What Was the Old Rule?

Under the earlier rule introduced in the Finance Act, 2023, banks were required to deduct a tax when someone withdrew cash from their account. This tax was charged only if:

- The person’s name was not on the Active Taxpayers List (ATL).

- The total cash withdrawn in a single day was more than Rs. 50,000.

In such cases, the bank would deduct 0.6% tax from the amount withdrawn. This was known as an advanced adjustable tax, meaning the person could later adjust it against their total tax liability.

What Changed in 2025?

With the Finance Act, 2025, the FBR increased the tax rate on cash withdrawals for persons not on the ATL. Now, banks will deduct 0.8% tax instead of 0.6% when:

- A person whose name is not on the ATL withdraws cash.

- The total cash withdrawn in one day exceeds Rs. 50,000.

This change took effect starting from the 2025 tax year and applies to all banks across Pakistan.

Learn more: Submit your own Return with Tax Return Master Course

Why Did the FBR Raise the Tax?

The main reason for increasing the tax rate is to encourage more people to become active taxpayers. When more people are registered and appear on the ATL, they:

- Pay taxes regularly.

- Help increase government revenue.

- Reduce informal cash transactions that are not taxed.

So, by raising the tax from 0.6% to 0.8%, the government wants to motivate individuals to file their tax returns and join the formal tax system.

How the Tax Works in Simple Terms

Let’s break it down in an easy way:

- If you withdraw cash worth Rs. 50,000 or less in one day, no tax is deducted.

- If you withdraw more than Rs. 50,000 in one day and your name is not on the ATL, the bank will deduct 0.8% tax on the total amount.

For example:

- Withdraw Rs. 60,000 → Tax is 0.8% of Rs. 60,000

- Withdraw Rs. 100,000 → Tax is 0.8% of Rs. 100,000

This tax is collected at the time of withdrawal by the bank as an advance adjustable tax.

Who Has to Pay This Tax?

This rule applies only to people who are not on the Active Taxpayers List (ATL). If your name is on the ATL, this tax does not apply to you when you withdraw cash, even if the amount is over Rs. 50,000.

Being on the ATL gives you many benefits, including lower tax rates on many transactions and fewer deductions by banks.

Read more: How to File Tax Return for Salary Person in 2026 in Pakistan

Conclusion

The increase from 0.6% to 0.8% tax on cash withdrawals under Section 231AB shows that Pakistan’s tax system is pushing for more transparency and compliance. If you are not on the ATL, you will pay a slightly higher tax when withdrawing large sums of cash. But if you register and file your taxes, you can avoid this extra cost and make your banking transactions smoother.