Imagine you have three different shops. They all sell “mutual funds” but each shop has slightly different rules, styles and strengths. Which one you pick should depend on who you are, what you need, and how comfortable you are with risk.

Here’s a straightforward look at these three “shops” what works for you, and what to watch out for.

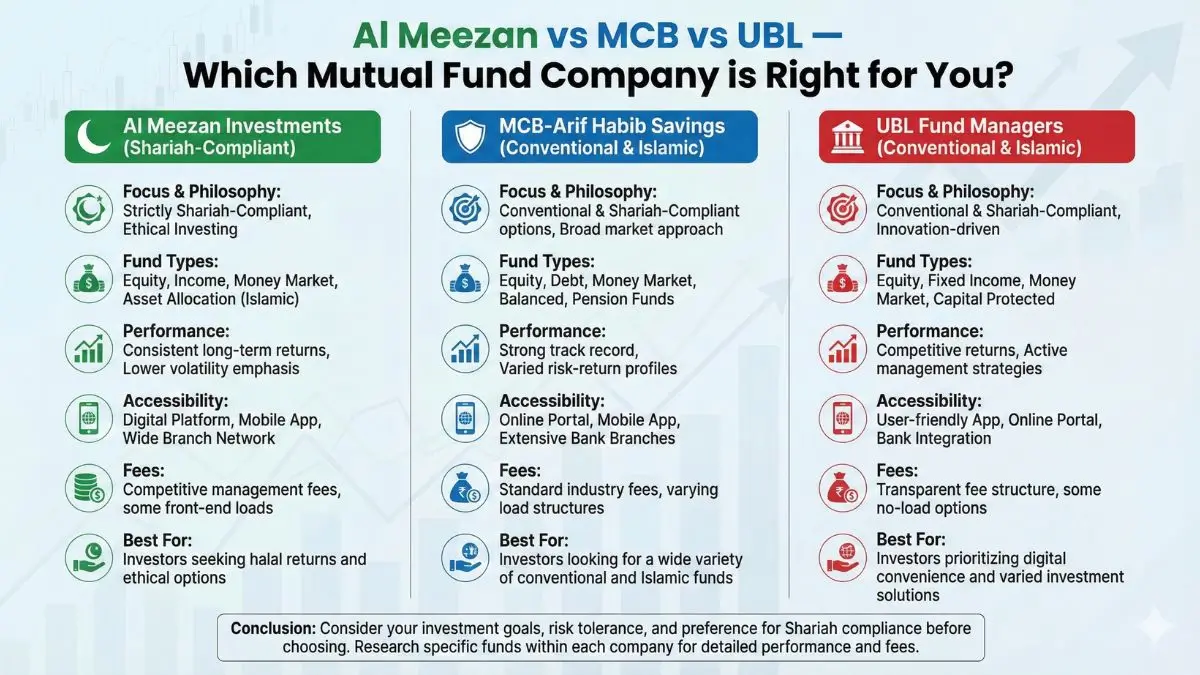

Who are these companies?

Al Meezan

- Al Meezan is known for offering only Shariah-compliant / Islamic funds.

- Over the last decade, it’s grown a lot: its total assets under management (AUM) rose from PKR 63 billion (circa 2015) to over PKR 633 billion (as of 2025) — showing strong growth and trust among investors.

- If you want to invest according to Islamic (halal) rules — avoiding interest-based or non-Shariah investments, Al Meezan is a top choice.

MCB Funds

- MCB Funds is part of a large conventional AMC in Pakistan, offering a wide range of conventional mutual funds (equity, income, balanced, etc.).

- As of September 2025, its open-end schemes, pension schemes and accounts together manage over PKR 526 billion+ across 233,000+ customers.

- For investors who want conventional fund options, flexibility, and a major AMC’s backing, MCB is a strong option.

UBL Fund Managers

- UBL Fund Managers is the mutual-fund division linked to a big bank (so backed by a bank’s resources), and offers a variety of funds — conventional and sometimes Shariah-compliant/Islamic-style (depending on fund).

- As of October 31, 2025, UBL Funds reports AUM around PKR 314.4 billion.

- They follow high standards: UBL has global-standard compliance for performance reporting (GIPS), which aims to ensure transparent and fair reporting for investors.

Read more: How to Choose right Al-Meezan fund?

What kinds of funds do they offer — and for whom?

| Company / AMC | Fund Types / Options | Best For… |

|---|---|---|

| Al Meezan | Islamic/ Shariah-compliant equity, asset-allocation, income and savings funds | People who care about halal investing / religion-based ethics, want peace of mind, want ethical portfolios |

| MCB Funds | Broad conventional mutual funds: equity, income, balanced, pension, savings, etc. | People who want flexibility, conventional funds, possibly higher variety in options |

| UBL Fund Managers | Mix of conventional & some Islamic-style, equity funds, fixed-income, money-market or government-securities funds too | People who want bank-backed fund house, reliability, mix of options and possibly easy access via bank channels |

Strengths of Each (What they are Good At)

Al Meezan Strengths

- Fully Shariah-compliant: ideal for those who want halal investing.

- Has grown a lot showing investor trust and stability.

- Simple values for many: ethical, religious, transparent.

MCB Funds Strengths

- A wide variety of conventional funds more choices depending on risk appetite and goals.

- High AUM and many customers implying reliability and experience.

- Good for people who don’t need Shariah compliance, and want flexible conventional investment vehicles.

UBL Fund Managers Strengths

- Bank-backed AMC that gives extra confidence for many investors.

- Transparent performance reporting (GIPS compliance) helps you compare funds honestly.

- Balanced offerings conventional, income, equity funds; for different investor needs.

What to Watch Out / Limitations

- If you choose Al Meezan, you limit yourself to only Shariah-compliant assets. That’s good for ethics/religion but reduces universe of possible investments.

- With MCB, you rely on conventional funds; might be less suitable if you want halal or ethical investing.

- With UBL, while bank-backed and transparent, you should check carefully: not all funds may be Shariah-compliant; you might pick conventional funds.

Also: mutual funds whether from Al Meezan, MCB or UBL are subject to market risk. Equity-heavy funds can go up or down depending on market conditions.

Which AMC Should You Choose Based on Your Profile?

Here’s a simple guideline:

- You care about religion / want only halal investments, go for Al Meezan

- You want wide choice, conventional funds, flexibility, go for MCB Funds

- You want bank-backed reliability, broad fund types, good reporting, go for UBL Fund Managers

If I were you, and I wanted clear choices, I’ll keep it simple:

- Halal & safe (Al Meezan)

- Conventional & flexible (MCB)

- Balanced & bank-backed (UBL)

A Few Real-Life Thoughts (For Everyday Investors)

- Mutual funds are like “shared baskets” of investments. You don’t need to pick individual stocks the AMC does it for you.

- You only need to choose which basket fits your risk level and goal.

- Don’t overthink too much. Once you pick an AMC and a fund type (safe / balanced / growth), stay invested for a while, then review.

- Many people even keep small amounts only you don’t need huge money to start.

Conclusion

All three; Al Meezan, MCB, and UBL are established and well-known in Pakistan mutual fund space. None is “perfect for everyone.” The “right” AMC depends on your values, your needs, and your comfort with risk.

If you want halal + simplicity, pick Al Meezan.

If you want variety and conventional funds, pick MCB.

If you want bank-backed trust + balanced choices, pick UBL.

Start small. Watch how your investment grows. And adjust with time if needed.

If you need any further assistance, then leave your question in the comments below.