We have arranged here the CSS Accountancy & Auditing Paper-II 2021. You can view or download this CSS Accountancy & Auditing Paper-II 2021. This is the 2nd paper of Accountancy & Auditing in CSS Examination held on 21-02-2021.

Get CSS Accountancy & Auditing Paper-II 2021

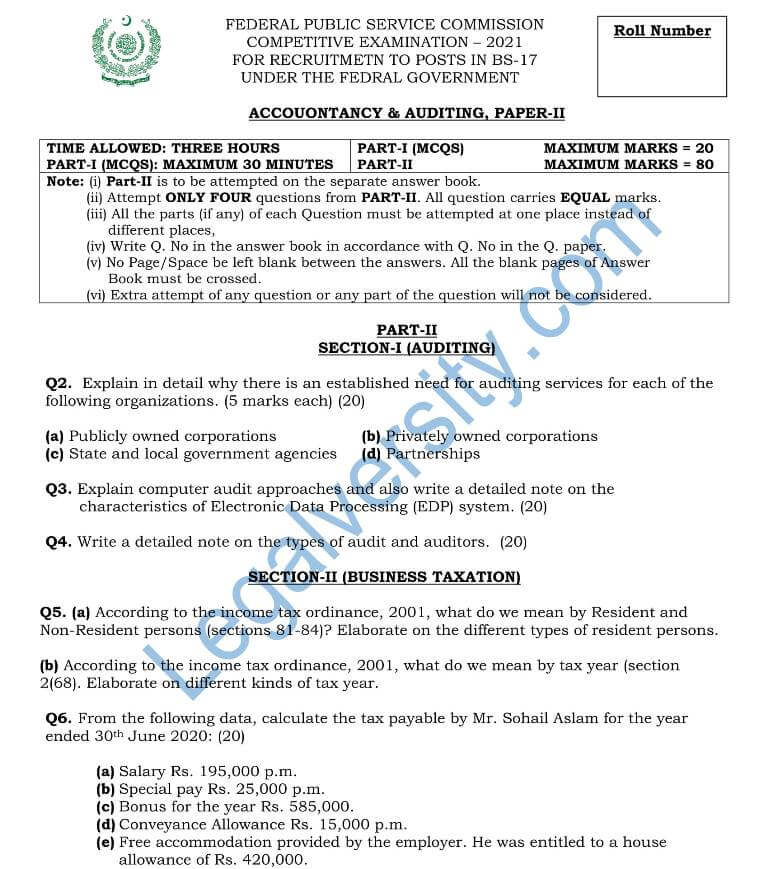

The following questions were given in the CSS Accountancy Paper-II 2021:

SECTION-I (AUDITING)

Q2. Explain in detail why there is an established need for auditing services for each of the following organizations.

(a) Publicly owned corporations (b) Privately owned corporations

(c) State and local government agencies (d) Partnerships

Q3. Explain computer audit approaches and also write a detailed note on the characteristics of the Electronic Data Processing (EDP) system.

Q4. Write a detailed note on the types of audits and auditors.

SECTION-II (BUSINESS TAXATION)

Q5. (a) According to the income tax ordinance, 2001, what do we mean by Resident and Non-Resident persons (sections 81-84)? Elaborate on the different types of resident persons.

(b) According to the income tax ordinance, 2001, what do we mean by tax year (section 2(68). Elaborate on different kinds of the tax year.

Q6. From the following data, calculate the tax payable by Mr. Sohail Aslam for the year ended 30th June 2020:

- Salary Rs. 195,000 p.m.

- Special pay Rs. 25,000 p.m.

- Bonus for the year Rs. 585,000.

- Conveyance Allowance Rs. 15,000 p.m.

- Free accommodation provided by the employer. He was entitled to a house allowance of Rs. 420,000.

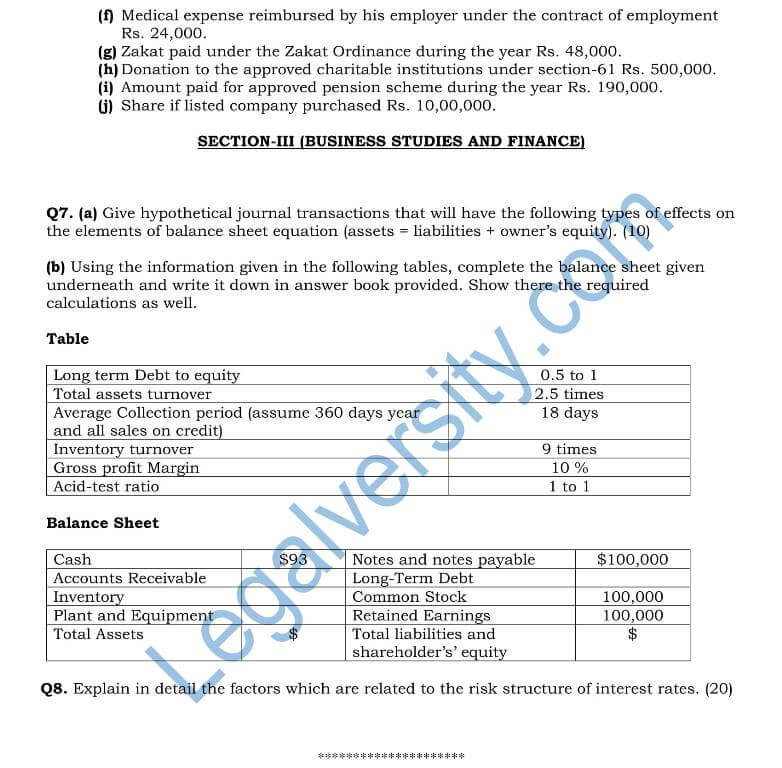

- Medical expense reimbursed by his employer under the contract of employment Rs. 24,000.

- Zakat paid under the Zakat Ordinance during the year Rs. 48,000.

- Donation to the approved charitable institutions under section-61 Rs. 500,000.

- Amount paid for approved pension scheme during the year Rs. 190,000.

- Share if the listed company purchased Rs. 10,00,000.

SECTION-III (BUSINESS STUDIES AND FINANCE)

Q7. (a) Give hypothetical journal transactions that will have the following types of effects on the elements of the balance sheet equation (assets = liabilities + owner’s equity).

(b) Using the information given in the following tables, complete the balance sheet given underneath and write it down in the answer book provided. Show there the required calculations as well.

Table

| Long term Debt to equity | 0.5 to 1 |

| Total assets turnover | 2.5 times |

| Average Collection period (assume 360 days a year and all sales on credit) | 18 days |

| Inventory turnover | 9 times |

| Gross profit margin | 10 % |

| Acid-test ratio | 1 to 1 |

Balance Sheet

| Cash | $93 | Notes and notes payable | $100,000 |

| Accounts Receivable | Long-Term Debt | ||

| Inventory | Common Stock | 100,000 | |

| Plant and Equipment | Retained Earnings | 100,000 | |

| Total Assets | $ | Total liabilities and shareholder’s equity | $ |

Q8. Explain in detail the factors which are related to the risk structure of interest rates.

You can Download this CSS Accountancy & Auditing Paper-II.

Other CSS (Compulsory) 2021 Papers:

➤ Essay

➤ English (Precis & Composition)

➤ Object (Precis & composition)

➤ Objective of English Grammar

➤ Islamic Studies

➤ Current Affairs

Other CSS (Optional) 2021 Papers:

➤ IR paper-I

➤ Economics Paper-I

➤ Economics Paper-II

➤ Political Science-I

➤ Political Science-II

➤ Accountancy & Auditing Paper-I

You may also like these:

- CSS Paper Papers 2020

- PMS Past Papers 2020

- CSS Examination 2021: Complete Guide for Beginners for CSS 2021

- PMS Syllabus: PMS Exam Syllabus for Compulsory and Optional Subjects

- English Essay: Write Effective Essay for CSS, PMS, and Judiciary Exams