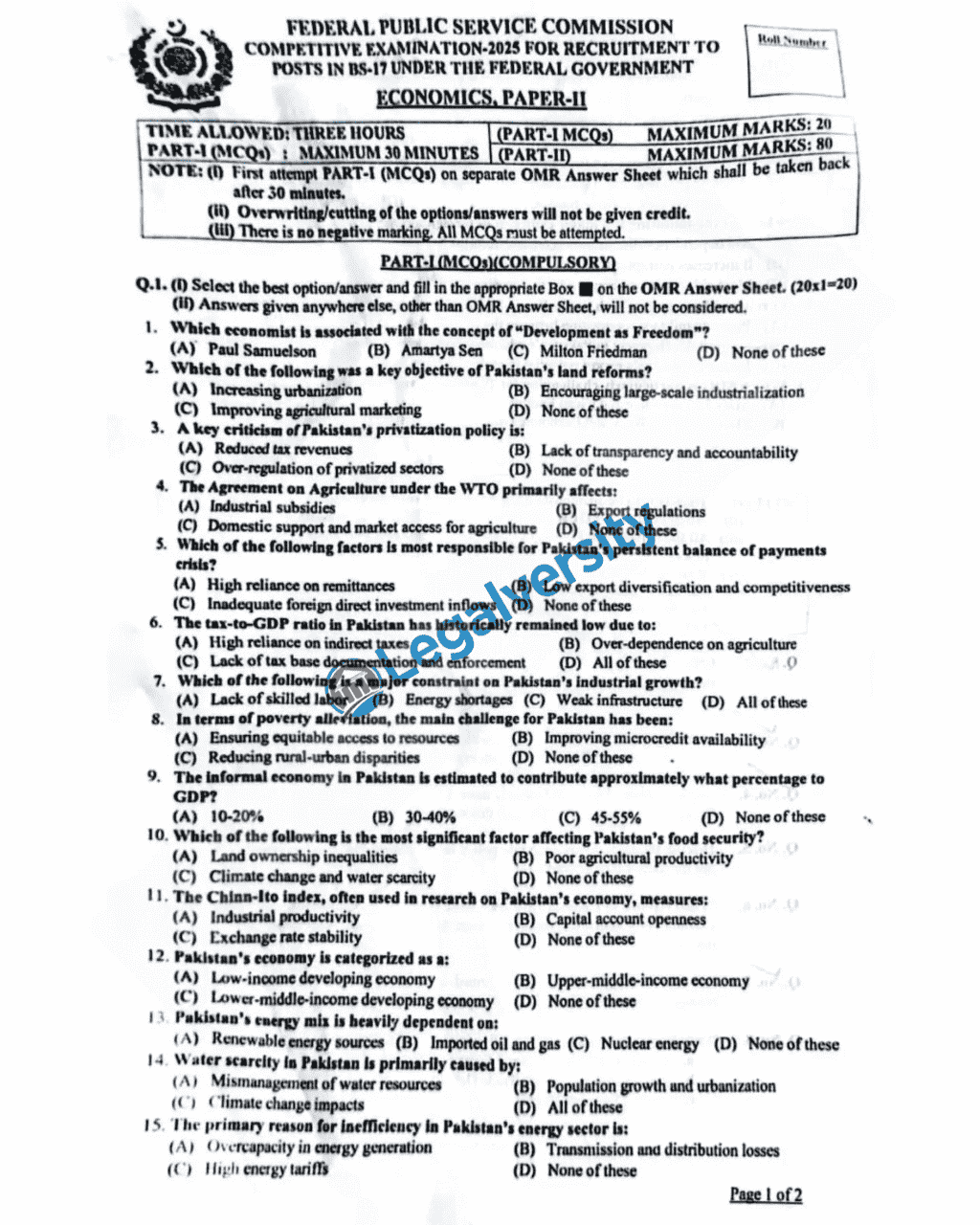

Economics is an optional subject in the CSS competitive examination 2025. Here, you will find the CSS Economics past Paper-II 2025. I will also provide a summary of the paper, in which you will analyze what topics were given and how difficult they were. This lets you better understand the paper and prepare well for future examinations.

CSS Economics Past Paper-II 2025

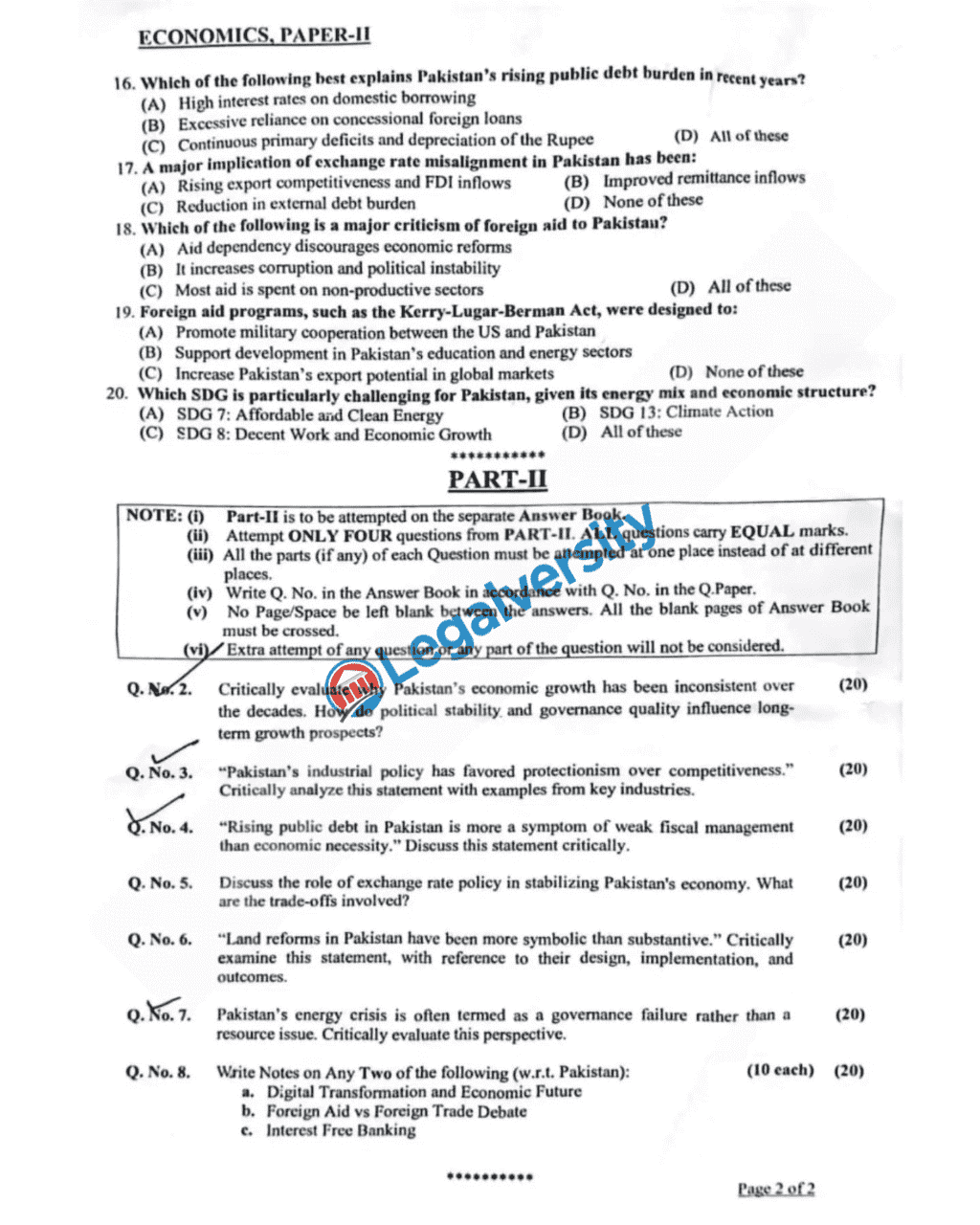

Q1. Critically evaluate why Pakistan’s economic growth has been inconsistent over the decades. How do political stability and governance quality influence long-term growth prospects?

Q2. “Pakistan’s industrial policy has favored protectionism over competitiveness.” Critically analyze this statement with examples from key industries.

Q3. “Rising public debt in Pakistan is more a symptom of weak fiscal management than economic necessity.” Discuss this statement critically.

Q4. Discuss the role of exchange rate policy in stabilizing Pakistan’s economy. What are the trade-offs involved?

Q5. “Land reforms in Pakistan have been more symbolic than substantive.” Critically examine this statement, with reference to their design, implementation, and outcomes.

Q6. Pakistan’s energy crisis is often termed as a governance failure rather than a resource issue. Critically evaluate this perspective.

Q7. Write notes on any two of the following (with reference to Pakistan):

- Digital Transformation and Economic Future

- Foreign Aid vs Foreign Trade Debate

- Interest-Free Banking

Critical Analysis of the Paper

Pakistan’s economic growth has been uneven because of political instability, governance issues, and policy u-turns. Although some years, like the 1960s and early 2000s, experienced high growth, others, especially the 1970s and after 2008, experienced stagnation. Political instability hampers long-term planning, whereas weak institutions and corruption discourage investment and economic reforms, impacting sustainable growth.

Pakistan’s industrial policy has traditionally been protectionist, protecting domestic industries from international competition instead of promoting competitiveness. Industries such as automobiles and textiles have enjoyed high tariffs and subsidies but are inefficient and dependent on government handouts. Such a strategy deters innovation and restricts export opportunities, rendering industries less competitive to international competition.

The increasing public debt of Pakistan primarily originates from poor fiscal management as opposed to needs. Reckless budgetary deficits, ineffective tax collection, and over-reliance on borrowing have created an unsustainable debt trap. Instead of enhancing revenue mobilization and containing expenditures, successive governments have pursued stopgap measures, resulting in recurring IMF bailouts.

The exchange rate policy is vital in stabilizing the economy of Pakistan and managing inflation, trade, and foreign reserves. A fixed exchange rate can be stabilizing but may cause overvaluation, which can hurt exports. A free-floating exchange rate mirrors market conditions but can be volatile, which may affect investor confidence. The key is to strike a balance that is conducive to trade and economic stability.

Land reforms in Pakistan have remained symbolic, with little effect on eroding feudal predominance or enhancing agricultural productivity. While reforms were initiated during the 1950s and 1970s, weak enforcement, loopholes in law, and resistance by the elite resulted in their failure. Huge landholders continued to exert control indirectly, thereby inhibiting effective redistribution and rural development.

Pakistan’s energy crisis is as much a failure of governance as a matter of resources. The nation has sufficient energy resources, but mismanagement, circular debt, and inefficient distribution networks have created persistent shortages. Inefficient planning, political meddling, and the absence of investment in infrastructure have worsened the crisis, impacting industries and daily life.

Digital Transformation and Economic Future: Pakistan’s digital transformation has tremendous economic potential. The digital economy, led by e-commerce, fintech, and IT exports, can create jobs and achieve financial inclusion. Digital infrastructure, regulatory barriers, and access to the internet are, however, major bottlenecks.

Foreign Aid vs. Foreign Trade Debate: Foreign aid has very often bred dependence instead of making Pakistan self-reliant. Diversification of exports and the broadening of foreign trade can create durable economic growth. Industry’s weak capacity and competitiveness, however, continue to remain obstacles to further growth in trade.

Interest-Free Banking: Islamic banking is expanding in Pakistan, as consumer demand increases and the government encourages it. The difficulty, though, is in creating interest-free financial products that work with economic realities and are Sharia-compliant.

View the CSS Economic past paper-II 2025

Also read: